6-K: Report of foreign issuer [Rules 13a-16 and 15d-16]

Published on July 3, 2025

Exhibit 10.2

Execution Version

DATED [●] 2025

DDC ENTERPRISE LIMITED

and

[●]

OPTION AGREEMENT

TABLE OF CONTENTS

| Clause | Headings | Page | ||

| 1 | Definitions | 3 | ||

| 2. | Put Option | 8 | ||

| 3. | Event of Default | 9 | ||

| 4. | Completion | 10 | ||

| 5. | Representations | 10 | ||

| 6 | Undertakings | 12 | ||

| 7 | Limited Recourse | 13 | ||

| 8 | Announcement | 13 | ||

| 9 | Costs | 13 | ||

| 10 | Payments | 14 | ||

| 11 | Time of Essence, Remedies and Waivers | 14 | ||

| 12 | General | 15 | ||

| 13 | Notices | 16 | ||

| 14 | Governing Law and Jurisdiction | 16 | ||

| Schedule 1 | Completion Deliverables | 18 | ||

| Schedule 2 | Conditions Precedent | 19 | ||

| Schedule 3 | Form of Put Option Exercise Note | 20 | ||

| Execution Page | 21 | |||

This Agreement is entered into on [●] 2025, by and between:

| (1) | [●] (the “Subscriber”); and |

| (2) | DDC ENTERPRISE LIMITED, an exempted company with limited liability incorporated under the laws of the Cayman Islands with its registered office situated at c/o International Corporation Services Ltd, P.O. Box 472, Harbour Place, 2nd Floor, 103 South Church Street, George Town, Grand Cayman, Cayman Islands KY1-1106 (“DDC” or the “Company”). |

(The Subscriber and DDC are collectively referred to as the “Parties” and “Party” means any of them).

| WHEREAS |

| (A) | By a subscription agreement dated on or about the date of this Agreement and made between the Subscriber and DDC (the “Subscription Agreement”), the Subscriber agreed to subscribe for certain Securities (as defined in the Subscription Agreement) of DDC, subject to and on the terms and conditions thereof. |

| (B) | In consideration of the Subscriber agreeing to enter into the Subscription Agreement and to assist in the management of the BTC reserves of DDC, to identify the most suitable fund manager to manage such asset and also provide best knowledge on the future acquisitions of BTC or other cryptocurrencies, DDC agrees to grant to the Subscriber the right to require DDC to direct the purchase or re-purchase of the Relevant Securities (as defined below) then held by the Subscriber or a part thereof on the terms and conditions set out in this Agreement. |

| (C) | The Subscriber and DDC shall execute and deliver this Agreement as a deed. |

NOW, THEREFORE, in consideration of the promises contained herein and intending to be legally bound, the parties agree as follows:

| 1 | Definitions |

| 1.1 | In this Agreement where the context so admits, the following words and expressions shall have the following meanings: |

“Anniversary” means each of the first (1st), second (2nd) and third (3rd) anniversaries of the Effective Date;

“BTC” means Bitcoin cryptocurrency;

“Closing Price” means for the Shares for any Trading Day the last reported price of the Shares published by or derived from Bloomberg (or its successor) for such day;

“Completion” means completion of the sale and purchase of the Relevant Securities then held by the Subscriber (or, if the Put Option is exercised in respect of part of the Relevant Securities, the part thereof) pursuant to Clause 4 of this Agreement;

“Completion Date” means the date of a Completion as determined under Clause 2.2 of this Agreement;

“Effective Date” means [●] 2025;

| Option agreement | 3 |

“Event of Default” has the meaning ascribed to it under Clause 3 of this Agreement;

“Exercise Date” means the date on which a Put Option Exercise Notice is served;

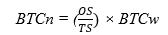

“Exercise Price” means, with respect to an Anniversary, a price to be paid in BTC determined as follows:

Where:

BTCn = Number of BTC to be delivered at Completion

OS = Number of Option Shares specified in the Put Option Exercise Note

TS = Total number of Relevant Securities held by the Subscriber on such Anniversary

BTCw = Number of BTC in the Wallet A BTC Reserve delivered by or on behalf of the Subscriber pursuant to its Subscription Agreement

“FCPA” means the United States Foreign Corrupt Practices Act of 1977, as amended from time to time (including the rules and regulations promulgated thereunder);

“Hong Kong” means the Hong Kong Special Administrative Region of the PRC;

“Maturity Date” means the first business day after the third (3rd) anniversary of the Effective Date;

“Market Capitalization” means at any time the product equal to the number of outstanding shares of the Company quoted on the NYSE American or other qualified exchange multiplied by the Closing Price per Share reported or published by or derived from Bloomberg (or its successor);

“NYSE American” means NYSE American LLC;

“OFAC” means Office of Foreign Assets Control of the United States Department of the Treasury;

“Option Shares” means:

| (a) | (if the Subscriber elects to exercise the Put Option in full) the number of Shares shall be equal to the number of the Relevant Securities then held by the Subscriber; or |

| (b) | (if the Subscriber elects to exercise the Put Option in an amount less than the total number of Relevant Securities) such lesser number of Shares; |

“PRC” means the People’s Republic of China;

“Put Option” has the meaning ascribed to it in Clause 2 of this Agreement;

“Put Option Exercise Event” means on any Anniversary, the Market Capitalization is less than the Target Market Capitalization;

| Option agreement | 4 |

“Put Option Exercise Notice” shall be in the form substantially set out in Schedule 3 hereto;

“Put Option Exercise Period” means the period within which the Put Option is exercisable, being from and including the Effective Date to and including the Maturity Date;

“Relevant Securities” means the “Securities” as defined under, and subscribed by the Subscriber, pursuant to the Subscription Agreement;

“Security Documents” means:

| (a) | the Collateral Agreement; and |

| (b) | any other security document for the time being or from time to time constituting security for the Secured Indebtedness and any other document which may be designated a Security Document by the Subscriber and DDC, and shall include all notices, acknowledgements or other documents required pursuant thereto or in connection therewith and reference to “Security Document” includes reference to any one thereof; |

“Security Interest” means (a) a mortgage, charge, pledge, lien or other encumbrance securing any obligation of any person, (b) any arrangement under which money or claims to, or for the benefit of, a bank or other account may be applied, set-off or made subject to a combination of accounts so as to effect payment of sums owed or payable to any person or (c) any other type of preferential arrangement (including title transfer and retention arrangements) having a similar effect;

“Shares” means the Class A ordinary shares of par value $0.4 each in the authorized share capital of DDC existing on the date of initial public offering of the shares in DDC and all other (if any) shares or stock from time to time and for the time being ranking pari passu therewith and all other (if any) shares or stock resulting from any sub-division, consolidation or re-classification thereof;

“Target Market Capitalization” for the purposes of a Put Option Exercise Event means, when DDC achieves a market capitalization of at least US$500 million;

“Tax” means all forms of taxation whether direct or indirect and whether levied by reference to income, profits, gains, asset values, turnover, added value or other reference and statutory, governmental, state, provincial, local governmental or municipal impositions, duties, contributions, rates and levies (including, without limitation, social security contributions and any other payroll taxes), whenever and wherever imposed (whether imposed by way of a withholding or deduction for or on account of tax or otherwise) and all penalties, charges, costs and interest relating thereto;

“Trading Day” means any day (other than Saturday or Sunday) on which the NYSE American is open for dealing business provided that if the NYSE American is closed for part of such day, or if no Closing Price in respect of the Shares is reported or published by or derived from Bloomberg (or its successor) for one or more consecutive dealing days, or no Shares have been traded on such dealing day(s), such day or days will be disregarded in any relevant calculation and shall be deemed not have existed when ascertaining any period of dealing days;

| Option agreement | 5 |

“Transaction Documents” means:

| (a) | this Agreement; |

| (b) | the Subscription Agreement; |

| (c) | the Security Documents; and |

| (e) | such other documents entered into on or after the date hereof by the Subscriber with DDC or an affiliate of DDC and which the parties thereto agree shall constitute a Transaction Document; |

“US Bankruptcy Filing Event” has the meaning ascribed to it in Clause 3 of this Agreement;

“US$” and “US Dollars” means the United States dollars, the lawful currency of the United States of America; and

“Wallet A BTC Reserve” means the Charged Wallet as defined under the Collateral Agreement.

| 1.2 | Unless a contrary indication appears, any reference in this Agreement to: |

| (i) | “affiliate” of any specified person means: |

| (a) | in the case where such specified person is a company, a subsidiary of such specified person, a holding company of such specified person or any other subsidiary of that holding company, |

| (b) | In the case where such specified person is an individual, any other person directly or indirectly controlled by such specified person, or |

| (c) | any other person who is a director or officer of: |

| (i) | such specified person, |

| (ii) | any person described in (a) or (b) above, or |

| (d) | any spouse, parent, child, brother or sister of such specified person or any person described in (c) above; |

| (ii) | Reference to any document expressed to be in the “agreed form” means a document approved by the Subscriber and DDC and, if not entered into contemporaneously with this Agreement, initialed by and on behalf of the parties for the purpose of identification. |

| (iii) | “applicable law or regulation” includes any law, regulation, rule (including any listing rules), official directive, request or guideline (whether or not having the force of law) of any governmental, intergovernmental or supranational body, agency, department, stock exchange or regulatory, self-regulatory or other authority or organization; |

| (iv) | “assets” includes present and future properties, revenues and rights of every description; |

| Option agreement | 6 |

| (v) | “authorisation” means: |

| (a) | an authorisation, consent, approval, resolution, licence, exemption, filing, notarization, lodgement or registration; or |

| (b) | in relation to anything which will be fully or partly prohibited or restricted by law if a governmental authority intervenes or acts in any way within a specified period after lodgement, filing, registration or notification, the expiry of that period without intervention or action; |

| (vi) | “business day” means a day (other than a Saturday or Sunday) on which banks are open for general business in Hong Kong and New York; |

| (vii) | “control” means the power to direct the management and policies of a body corporate, whether through the ownership of voting capital, by contract or otherwise and “controlled” shall be construed accordingly; |

| (viii) | the “equivalent” on any date in one currency (the “first currency”) of an amount denominated in another currency (the “second currency”) means a reference to the amount of the first currency which could be purchased with the amount of the second currency at the spot rate of exchange quoted by the Hongkong and Shanghai Banking Corporation Limited at or about 11:00 a.m. (Hong Kong time) on such date for the purchase of the first currency with the second currency; |

| (ix) | “governmental authority” means any government or any governmental agency, semi-governmental or judicial entity or authority (including, without limitation, any stock exchange or any self-regulatory organization established under statute); |

| (x) | “including” shall be construed as “including without limitation” (and cognate expressions shall be construed similarly); |

| (xi) | in this Agreement, the expressions “subsidiary” and “holding company” shall have the same meanings as their respective definitions in the Companies Ordinance (Cap.622 of the Laws of Hong Kong); |

| (xii) | a “person” includes any individual, firm, company, corporation, government, state or agency of a state or any association, trust, joint venture, consortium or partnership (whether or not having separate legal personality); |

| (xviii) | “DDC”, any “Party” or “Subscriber”, shall be construed so as to include its successors in title, permitted assigns and permitted transferees; |

| (xiv) | a provision of law is a reference to that provision as amended or re-enacted; and |

| (xv) | unless a contrary indication appears, a time of day is a reference to Hong Kong time. |

| 1.3 | Clause and Schedule headings are for ease of reference only. |

| 1.4 | The masculine gender shall include the feminine and neuter and the singular number shall include the plural and vice versa. |

| Option agreement | 7 |

| 1.5 | Save where the contrary is indicated, any reference in this Agreement to this Agreement or any other agreement or document or consent or approval shall be construed as a reference to this Agreement or, as the case may be, such other agreement or document or consent or approval as the same may have been, or may from time to time be, amended, varied, novated or supplemented. |

| 1.6 | Unless expressly provided to the contrary in a Transaction Document, a person who is not a party to this Agreement has no right under the Contracts (Rights of Third Parties) Ordinance (Cap. 623) to enforce or to enjoy the benefit of any term of this Agreement. Notwithstanding any term of this Agreement or any other Transaction Document, the consent of any person who is not a party to this Agreement is not required to rescind or vary this Agreement at any time. |

| 2. | Put Option |

| 2.1 | As and from the Effective Date, DDC irrevocably grants to the Subscriber the right (but not the obligation) to require DDC to designate the purchase of or to repurchase the Relevant Securities held by the Subscriber or a part thereof (as the Subscriber may elect in its absolute discretion) at the applicable Exercise Price and on the terms set forth below in this Agreement (referred to herein as the “Put Option”). |

| 2.2 | The Subscriber may exercise the Put Option by submitting a Put Option Exercise Notice to DDC at any time during the Put Option Exercise Period following the occurrence of a Put Option Exercise Event. A Put Option Exercise Notice shall specify a date the Completion that is not less than sixty (60) days nor more than ninety (90) days from the Exercise Date; provided that DDC may request for a 60-day extension of such date of Completion if such extension is reasonably required by DDC (or its designated purchaser) to arrange for funding of the Exercise Price. |

| 2.3 | The Put Option may be exercised: |

| 2.3.1 | not more than once in any period of twelve (12) consecutive months; |

| 2.3.2 | only during the Put Option Exercise Period; |

| 2.3.3 | no more than twice during the Put Option Exercise Period; and |

| 2.3.4 | without prejudice to Clause 3(A) hereof upon the occurrence of an Event of Default. |

| 2.4 | Any Put Option Exercise Notice, once issued, is irrevocable. Where the Put Option is exercised in respect of part of the Relevant Securities then held by the Subscriber (but not all), the number of Relevant Securities in respect of which the Put Option is exercised shall be as stated in the Put Option Exercise Notice. |

| 2.5 | The Parties hereto agree that the obligations of the Subscriber to purchase and pay for the Securities specified on the Subscription Agreement shall be conditional upon the Subscriber receiving all of the documents and other evidence listed in Schedule 2 (Conditions Precedent) in form and substance satisfactory to the Subscriber. The Subscriber shall notify DDC promptly upon being so satisfied. |

| Option agreement | 8 |

| 3. | Event of Default |

Each of the events or circumstances set out in the following Clauses 3.1 to Clause 3.9 of this Agreement is an Event of Default (an “Event of Default”):

| 3.1 | DDC does not pay on the due date any amount payable pursuant to a Transaction Document at the place at and in the currency in which it is expressed to be payable; |

| 3.2 | DDC does not comply with any provision of the Transaction Documents; |

| 3.3 | Any representation or statement made or deemed to be made by DDC in the Transaction Documents or any other document delivered by or on behalf of DDC under or in connection with a Transaction Document is or proves to have been incorrect or misleading in any material respect when made or deemed to be made; |

| 3.4 | DDC is or is presumed or deemed to be unable or admits inability to pay its debts as they fall due, suspends making payments on any of its debts or, by reason of actual or anticipated financial difficulties, commences negotiations with one or more of its creditors with a view to rescheduling any of its indebtedness. The value of the assets of DDC is less than its liabilities (taking into account contingent and prospective liabilities). A moratorium is declared in respect of any indebtedness of DDC; |

| 3.5 | Any corporate action, legal proceedings or other procedure or step is taken in relation to: (a) the suspension of payments, a moratorium of any indebtedness, winding-up, dissolution, administration, provisional supervision or reorganisation (by way of voluntary arrangement, scheme of arrangement or otherwise) of DDC; (b) a composition or arrangement with any creditor of DDC, or an assignment for the benefit of creditors generally of DDC or a class of such creditors; (c) the appointment of a liquidator, receiver, administrator, administrative receiver, compulsory manager, provisional supervisor or other similar officer in respect of DDC or any of its assets; or (d) enforcement of any Security interest over any assets of DDC, or in each case of the foregoing, any analogous procedure or step is taken in any jurisdiction; |

| 3.6 | (a) A court of competent jurisdiction shall enter a decree or order for relief in respect of DDC, in an involuntary case under the United States Bankruptcy Code or under any other applicable United States federal or state bankruptcy, insolvency or similar law now or hereafter in effect (collectively, “US Bankruptcy Laws”); or any other similar relief shall be granted under any applicable federal or state law; (b) DDC, pursuant to or within the meaning of any US Bankruptcy Laws, shall (i) commence a voluntary case or proceeding or (ii) make a general assignment for the benefit of its creditors; or (c) an involuntary case shall be commenced against DDC under any US Bankruptcy Law or a moratorium is declared in respect of any indebtedness of DDC, as the case may be; or a decree or order of a court having jurisdiction in the premises for the appointment of a receiver, liquidator, sequestrator, trustee, conservator, custodian or other officer having similar powers over DDC, or over all or a substantial part of its respective assets, shall have been entered; or there shall have occurred the involuntary appointment of an interim receiver, trustee, conservator or other custodian of DDC for all or a substantial part of its assets; or a warrant of attachment, execution or similar process shall have been issued against any substantial part of the property of DDC (the occurrence of any of the foregoing, a “US Bankruptcy Filing Event”); |

| 3.7 | (a) Any expropriation, attachment, sequestration, distress or execution affects any asset or assets of DDC. (b) It is or becomes unlawful for DDC to perform any of its obligations under the Transaction Documents. (c) DDC suspends or ceases to carry on all or a material part of its business; and |

| Option agreement | 9 |

| 3.8 | Ms Norma Chu ceases to control DDC. |

(A) On and at any time after the occurrence of an Event of Default (other than a US Bankruptcy Filing Event), subject to the fullest extent permitted by applicable laws and regulations, the Subscriber may deliver a Put Option Exercise Notice to DDC requiring DDC to purchase all of the Relevant Securities then held by the Subscriber (but not some only) at a price equal to all BTC standing to the credit of the Wallet A BTC Reserve; and (B) if a US Bankruptcy Filing Event occurs, DDC will automatically be obligated, to purchase all of the Relevant Securities then held by the Subscriber (but not some only) at a price equal to all BTC standing to the credit of the Wallet A BTC Reserve; provided that in each case under (A) and (B), any Put Option Exercise Notice delivered prior to the occurrence of such Event of Default that has not been consummated under Clause 4 of this Agreement shall be deemed to be cancelled and shall cease to be in full force and effect.

| 4. | Completion |

| 4.1 | Each Completion shall take place as soon as practicable following the applicable Exercise Date (or such other business day as may be agreed between the Subscriber and DDC in writing) when all (but not some only) of the events described in this Clause 4 shall occur. |

| 4.2 | On the applicable Completion Date: (a) DDC shall pay the Exercise Price to the Subscriber without any set-off or deduction to such account (or BTC wallet) as may be notified by the Subscriber to DDC prior to such Completion Date; and (b) the Subscriber shall deliver DDC or such persons as DDC may designate all the documents referred to in Schedule 1 to this Agreement. |

| 4.3 | For avoidance of doubt, the Subscriber is only obliged to complete the sale of the Option Shares then held by the Subscriber (or, if the Put Option is exercised in respect of part of the Option Shares then held by the Subscriber, the part thereof) when DDC complies with its obligations pursuant to this Agreement in all material respects. Notwithstanding anything to the contrary contained in this Agreement, all purchases or repurchases of the Option Shares then held by the Subscriber and agreements shall not be effective until prior approval of such transaction (if any) has been received as and to the fullest extent required by applicable law. |

| 5. | Representations |

| 5.1 | Each of the Subscriber and DDC represents to the other Party that: |

| 5.1.1 | It is duly organized and validly existing under the laws of the jurisdiction of its organization or incorporation and, if relevant under such laws, in good standing; |

| 5.1.2 | It has the power to execute and deliver this Agreement and any other Transaction Document to which it is a party and to perform its obligations under this Agreement and any other Transaction Document to which it is a party, and has taken all action necessary to authorize such execution and delivery and the performance of such obligations; |

| 5.1.3 | None of its execution, delivery or performance of its obligations under this Agreement and any other Transaction Document to which it is a party will violate (i) any applicable laws or regulation to it, (ii) any provision of its articles of association or constitutional documents or (iii) any agreement to which it or any of its assets is subject; |

| Option agreement | 10 |

| 5.1.4 | It has obtained all applicable governmental or other regulatory approvals and consents that are required to be obtained by it in respect of its entry into, and performance of, this Agreement and any other Transaction Document to which it is a party, all such approvals and consents are in full force and effect and any conditions of such approvals and consents have been satisfied; |

| 5.1.5 | This Agreement and any other Transaction Document to which it is a party constitutes its legal, valid and binding obligations, enforceable against it in accordance with its terms (subject to applicable, bankruptcy, reorganization, insolvency, moratorium or similar laws affecting creditors’ rights generally and subject, as to enforceability, to equitable principles of general application (regardless of whether enforcement is sought in a proceeding in equity or at law)); |

| 5.1.6 | Its payment obligations under the Transaction Documents to which it is a party rank at least pari passu with the claims of all of its other unsecured and unsubordinated creditors, except for obligations mandatorily preferred by law applying to companies generally; and |

| 5.1.7 | The choice of Hong Kong law as the governing law in the Transaction Documents will be recognized and upheld in the jurisdiction in which it is incorporated. |

| 5.2 | The Subscriber represents to DDC on each Completion Date that: |

| 5.2.1 | At Completion, the Subscriber will be the sole legal and beneficial owner and registered holder of the Relevant Securities then held by the Subscriber (or if the Subscriber elects to exercise the Put Option in an amount less than the total number of Relevant Securities, such lesser number of Relevant Securities), and will have good and valid title to such Relevant Securities, in each case, free and clear of all Security Interests and other rights exercisable by third parties (or which Security Interests will be released substantially simultaneous with the occurrence of such Completion); |

| 5.2.2 | At Completion, the Subscriber will be entitled to sell and transfer, and shall at Completion sell and transfer, the Relevant Securities then held by the Subscriber (or if the Subscriber elects to exercise the Put Option in an amount less than the total number of Relevant Securities, such lesser number of Relevant Securities) to DDC or its designees free and clear of all Security Interests and with all rights then and thereafter relating to such Relevant Securities (or which Security Interests will be released substantially simultaneous with the occurrence of such Completion); and |

| 5.2.3 | The Subscriber is aware of the FCPA and is committed to strict FCPA compliance. In particular, |

| (a) | it is familiar with the FCPA and its purposes, including its prohibition against it and its directors, officers, agents, employees, affiliates or other persons acting on its behalf, from taking corrupt actions in furtherance of an offer, payment, promise to pay or authorization of the payment of anything of value, including but not limited to cash, checks, wire transfers, tangible and intangible gifts, favours, services, and those entertainment and travel expenses that go beyond what is reasonable and customary and of modest value, to: (i) an executive, official, employee or agent of a governmental department, agency or instrumentality, (ii) a director, officer, employee or agent of a wholly or partially government-owned or controlled company or business, (iii) a political party or official thereof, or candidate for political office, or (iv) an executive, official, employee or agent of a public international organization (e.g., the International Monetary Fund or the World Bank) (“Government Official”); while knowing or having a reasonable belief that all or some portion will be used for the purpose of: (x) influencing any act, decision or failure to act by a Government Official to use his or her influence with a government or instrumentality to affect any act or decision of such government or entity, or (z) securing an improper advantage; in order to obtain, retain, or direct business; and |

| Option agreement | 11 |

| (b) | it is now in compliance with the laws of those countries where it operates, including all applicable anti-bribery or anticorruption laws, and will remain in compliance with such laws; that it is now in compliance with the FCPA if it is subject to the FCPA; it will not authorize, offer or make payments directly or indirectly to any Government Official that would result in a violation of the FCPA; |

| 5.2.4 | None of the Subscriber or any of its directors, officers, agents, employees, affiliates or other persons acting on its behalf is subject to any sanctions administered by OFAC; and |

| 5.2.5 | The Subscriber complies with all applicable laws or regulation on anti-money laundering in accordance with applicable laws or regulation. |

| 5.3 | DDC represents to the Subscriber on each Completion Date that: |

| 5.3.1 | At Completion, DDC will be the sole legal and beneficial owner and registered holder of the BTC that comprises the Exercise Price, and will have good and valid title to such BTC, in each case, free and clear of all Security Interests and other rights exercisable by third parties (or which Security Interests will be released substantially simultaneous with the occurrence of such Completion); and |

| 5.3.2 | At Completion, DDC will be entitled to transfer, and shall at Completion transfer, the BTC that comprises the Exercise Price to the Subscriber free and clear of all Security Interests and with all rights then and thereafter relating to such BTC (or which Security Interests will be released substantially simultaneous with the occurrence of such Completion); and |

| 5.4 | The representations and warranties set out in Clauses 5.1 shall be deemed to be repeated immediately before Completion by reference to the facts and circumstances then existing. |

| 6 | Undertakings |

| 6.1 | Each of the Subscriber and DDC undertakes to the other Party that until the Put Option Exercise Period has expired: |

| 6.1.1 | It shall maintain its corporate existence and its right to carry on operations; |

| 6.1.2 | It shall obtain, maintain in full force and effect and comply with the terms of each authorisation, approval and registration required under any applicable law or regulation to enable it to perform its obligations under, or for the validity, enforceability or admissibility of, any Transaction Document to which it is a party; and |

| Option agreement | 12 |

| 6.1.3 | It shall ensure that its payment obligations under the Transaction Documents to which it is a party rank and continue to rank at least pari passu with the claims of all its other unsecured and unsubordinated creditors, except for obligations mandatorily preferred by law applying to companies generally; |

| 6.2 | To the fullest extent permitted by applicable laws and regulations, DDC undertakes to the Subscriber that, at any time until the Put Option Exercise Period has expired, DDC shall not disclose any information to the Subscriber where DDC reasonably believes that such disclosure (x) would result in it not being in compliance with applicable laws and regulations or (y) would require DDC to disclose material non-public information with respect to DDC or its securities (“Insider Information”) provided always in each case where such disclosure to the Subscriber will not contravene any applicable laws and regulations with appropriate non-disclosure arrangements that the Subscriber has first been offered an opportunity to enter into non-disclosure arrangements in writing with DDC in relation to such Insider Information. DDC hereby acknowledges that the Subscriber does not wish to receive Insider Information and agrees that DDC will use commercially reasonable efforts to omit any Insider Information from any notice, document or information required to be provided to the Subscriber pursuant to any notice, document or information required to be provided to the Subscriber pursuant the Transaction Documents and that by delivering such notice, document or information to the Subscriber, DDC shall be deemed to have authorized the Subscriber to treat such notice, document or information as not containing any material non-public information (although it may be sensitive or proprietary) with respect to DDC and its securities under any applicable law and regulations. |

| 7 | Limited Recourse |

The Subscriber hereby agrees and expressly acknowledges that all rights and recourse of the Subscriber under this Agreement shall be strictly limited to the Charged Property (as defined in the Collateral Agreement).

| 8 | Announcement |

No announcement or Form 6-K report or other documents in connection with the existence or the subject matter of this Agreement, any other Transaction Document or document referred to herein shall be made or issued by or on behalf of any party (or its holding company) without the prior written approval of the other Party. This shall not affect any announcement or Form 6-K report or other documents required by law or by any securities exchange or supervisory or regulatory or governmental body pursuant to rules to which the Parties (or their respective holding companies) are subject, but the party (or its holding company) with an obligation to make an announcement or issue a circular shall consult with the other parties where feasible before complying with such an obligation.

| 9 | Costs |

| 9.1 | Each Party shall pay its own costs and expenses (including, without limitation, legal fees) incurred by it in connection with (i) the negotiation, preparation, printing and execution of, and (ii) the enforcement of, or preservation of any rights under, this Agreement and any other Transaction Document. |

| Option agreement | 13 |

| 9.2 | The ad valorem stamp duty (if any) payable on any transfer of the Relevant Securities under Clause 4 of this Agreement shall be paid by DDC. |

| 9.3 | DDC undertakes to provide all reasonable assistance to the Subscriber in connection with the stamping (if required) of documentation relevant to any transfer of Option Shares under Clause 4 of this Agreement, including by way of providing any further documents requested by any governmental authority. |

| 10 | Payments |

| 10.1 | Payments by DDC |

| 10.1.1 | On each date on which DDC is required to make a payment under this Agreement or any other Transaction Document, DDC shall make the same available to the Subscriber (unless a contrary indication appears) for value on the due date at the time and in clear and immediately available funds or by delivery of BTC equivalent or otherwise specified by the Subscriber as being customary at the time for settlement of transactions in the relevant currency or token in the place of payment. |

| 10.1.2 | Payment shall be made to such account or wallet address as the Subscriber has specified to DDC from time to time by not less than three (3) business days’ prior notice in writing or in such manner as the Subscriber and DDC shall from time to time agree. |

| 10.2 | Payments by the Subscriber |

All amounts payable to DDC under this Agreement shall be paid to the Wallet A BTC Reserve or such account or wallet as DDC may notify to the Subscriber by not less than five (5) business days’ notice in writing or in such manner as DDC and the Subscriber shall from time to time agree.

| 10.3 | Currency of Account |

| 10.3.1 | Subject to Clause 3, Clause 4.2 and Clause 10.2, US Dollars is the currency of account and payment for any sum due under this Agreement. |

| 10.3.2 | Any amount expressed to be payable in a currency other than US Dollars shall be paid in that other currency. |

| 11 | Time of Essence, Remedies and Waivers |

| 11.1 | Time is of the essence of this Agreement as regards any time, date or period specified for performance of an obligation. |

| 11.2 | No time or indulgence given by any party to the other shall be deemed or in any way be construed as a waiver of any of its rights and remedies hereunder. |

| 11.3 | The single or partial exercise of any right, power or remedy provided by law or under this Agreement shall not preclude any other or further exercise of it or the exercise of any other right, power or remedy. |

| Option agreement | 14 |

| 11.4 | The rights, powers and remedies provided in this Agreement are cumulative and not exclusive of any rights, powers and remedies provided by law. |

| 12 | General |

| 12.1 | This Agreement shall be binding upon and inure for the benefit of the assigns and successors of the parties. |

| 12.2 | DDC may not assign this Agreement or any of its rights and/or transfer any of its obligations under this Agreement to any third party without the prior written consent of the Subscriber. The Subscriber may not assign this Agreement or any of its rights and/or transfer any of its obligations under this Agreement to any third party without the prior consent of DDC. |

| 12.3 | This Agreement and any other Transaction Document (together with the other documents referred to herein) constitute the whole agreement between the parties relating to the subject matter of this Agreement and supersedes any previous agreements or arrangements between them relating to the subject matter of this Agreement (and any other the other documents referred to herein). |

| 12.4 | No variations of this Agreement shall be effective unless made in writing signed by duly authorized representatives of the parties hereto. |

| 12.5 | Any certification or determination by DDC of a rate or amount under any Transaction Document to which it is party is, in the absence of manifest error, conclusive evidence other matters to which it relates. |

| 12.6 | All of the provisions of this Agreement shall remain in full force and effect notwithstanding the expiry of the Put Option Exercise Period (except insofar as they set out obligations which have been fully performed at such completion). |

| 12.7 | If any provision or part of a provision of this Agreement shall be, or be found by any authority or court of competent jurisdiction to be, invalid or unenforceable, such invalidity or unenforceability shall not affect the other provisions or parts of such provisions of this Agreement, all of which shall remain in full force and effect. |

| 12.8 | Any right of rescission conferred upon a party herby shall be in addition to and without prejudice to all other rights and remedies available to it (and, without prejudice to the generality of the foregoing, shall not extinguish any right to damages to which such party may be entitled in respect of the breach of this agreement) and no exercise or failure to exercise such a right of rescission shall constitute a waiver by such party of any such other right or remedy. |

| 12.9 | No failure of a party to exercise, and no delay or forbearance in exercising, any right or remedy in respect of any provision of this Agreement shall operate as a waiver of such right or remedy. |

| 12.10 | At any time after the date of this Agreement, each party shall, and shall use all reasonable endeavours to procure (to the extent it is legally or contractually entitled to do so) that any necessary third party shall, execute such documents and do such acts and things as the other parties may reasonable require for the purpose of giving to such parties the full benefit and provisions of this Agreement. |

| Option agreement | 15 |

| 12.11 | This Agreement may be executed in one or more counterparts, and by the parties on separate counterparts, but shall not be effective until each party has executed at least one counterpart and each such counterpart shall constitute an original of this Agreement but all the counterparts shall together constitute one and the same instrument. |

| 13 | Notices |

| 13.1 | Any notice or other communication in connection with this Agreement shall be in writing in English (a “Notice”) and shall be sufficiently given or served if delivered or sent: |

To DDC to:

| Address | : | 368 9th Ave., 6th Fl., New York, New York 10001 | |

| Attention | : | Norma Chu |

To the Subscriber to:

| Address: | [●] |

| Attention: | [●] |

or to such other address or fax number in Hong Kong as each party above may have notified to the other parties to this Agreement in writing in accordance with this Clause 13.

| 13.2 | Unless there is evidence that it was received earlier, a Notice is effective when: |

| (a) | delivered personally, when left at the address referred to in Clause 13.1; |

| (b) | sent by prepaid registered post or courier, two (2) business days after posting it; |

| (c) | sent by air mail, five (5) business days after posting it; and |

| (d) | sent by fax, when confirmation of its transmission has been recorded by the sender’s fax machine. |

| 14 | Governing law and Jurisdiction |

| 14.1 | This Agreement and any non-contractual obligations arising out of or in connection with it shall be governed by and construed in all respects in accordance with the laws of Hong Kong. |

| 14.2 | Each Party hereto irrevocably agrees that the courts of Hong Kong shall have non-exclusive jurisdiction to hear and determine any suit, action or proceedings, and to settle any disputes, which may arise out of or in connection with this Agreement (respectively “Proceedings” and “Disputes”) and, for such purposes, irrevocably submits to the jurisdiction of such courts. |

| 14.3 | Without prejudice to any other mode of service allowed under any relevant law, DDC: |

| (a) | irrevocably appoints [●] (the “DDC Process Agent”) as its agent for service of process in relation to any Proceedings before the Hong Kong courts in connection with any Transaction Document; and |

| Option agreement | 16 |

| (b) | agrees that failure by a process agent to notify the DDC Process Agent of the process will not invalidate the Proceedings concerned. |

If any person appointed as an agent for service of process is unable for any reason to act as agent for service of process, DDC must immediately (and in any event within 10 days of such event taking place) appoint another agent on terms acceptable to the Subscriber. Failing this, the Subscriber may appoint another agent for this purpose.

| 14.4 | Without prejudice to any other mode of service allowed under any relevant law, the Subscriber: |

| (a) | irrevocably appoints [●] (the “Subscriber Process Agent”) as its agent for service of process in relation to any Proceedings before the Hong Kong courts in connection with any Transaction Document; and |

| (b) | agrees that failure by a process agent to notify the Subscriber Process Agent of the process will not invalidate the Proceedings concerned. |

If any person appointed as an agent for service of process is unable for any reason to act as agent for service of process, the Subscriber must immediately (and in any event within 10 days of such event taking place) appoint another agent on terms acceptable to DDC. Failing this, DDC may appoint another agent for this purpose.

| 14.5 | Each Party irrevocably waives any objection which it might now or hereafter have to the courts referred to in Clause 14.1 of this Agreement being nominated as the forum to hear and determine any Proceedings and to settle any Disputes and agrees not to claim that any such court is not a convenient or appropriate forum. |

| 14.6 | The submission to the jurisdiction of the courts referred to in Clause 14.1 of this Agreement shall not (and shall not be construed so as to) limit the right of each of the Subscriber and DDC to take Proceedings against the other Party in any other court of competent jurisdiction nor shall the taking of Proceedings in any one or more jurisdictions preclude the taking of Proceedings in any other jurisdiction (whether concurrently or not) if and to the extent permitted by applicable law. |

| 14.7 | Each Party hereby consents generally in respect of any Proceedings to the giving of any relief or the issue of any process in connection with such Proceedings including the making, enforcement or execution against any property whatsoever (irrespective of its use or intended use) of any order or judgment which may be made or given in such Proceedings. |

| 14.8 | To the fullest extent permitted by law, each Party hereby irrevocably agrees that no immunity (to the extent that it may at any time exist, whether on the grounds of sovereignty or otherwise) from any proceedings, from attachment (whether in aid of execution, before judgment or otherwise) of its assets or from execution of judgment shall be claimed by it or on its behalf or with respect to its assets, any such immunity being irrevocably waived. To the fullest extent permitted by law, each Party hereby irrevocably agrees that it and its assets are, and shall be, subject to such proceedings, attachment or execution in respect of its obligations under the Transaction Documents. |

| Option agreement | 17 |

Schedule 1

Completion Deliverables

At the election of the Subscriber, either:

| 1. | each of the following original documents: |

| 1.1 | all share certificates in respect of the Relevant Securities then held by the Subscriber (or, if the Put Option is exercised in respect of part of the Relevant Securities then held by the Subscriber, the part thereof) held by the Subscriber together with all originals of declarations of trusts (if any); and |

| 1.2 | duly executed and undated instruments of transfer in relation to such Relevant Securities in favour of DDC (or its nominee); or |

| 2. | evidence that such Relevant Securities have been delivered to the securities account in the name of DDC or its designated purchaser. |

| Option agreement | 18 |

Schedule 2

Conditions Precedent

| 1. | DDC |

| (a) | A copy of the constitutional documents of DDC. |

| (b) | A copy of a resolution of the board of directors of DDC: |

| (i) | approving the terms of, and the transactions contemplated by, the Transaction Documents and resolving that it execute the Transaction Documents; |

| (ii) | authorising a specified person or persons to execute the Transaction Documents; and |

| (iii) | authorising a specified person or persons, on its behalf, to sign and/or despatch all documents and notices to be signed and/or despatched by it under or in connection with the Transaction Documents. |

| (c) | A certificate of an authorised signatory of DDC certifying that each copy document relating to it specified in this Schedule 2 is correct, complete and in full force and effect as at a date no earlier than the date of this Agreement. |

| 2. | Legal opinions |

| (a) | A legal opinion in relation to Hong Kong law from DDC’s Hong Kong counsel, addressed to the Subscriber, substantially in the form distributed to the Subscriber prior to signing this Agreement; and |

| (b) | A legal opinion as to Cayman Islands from Travers Thorp Alberga addressed to the Subscriber, substantially in the form distributed to the Subscriber prior to signing this Agreement. |

| 3. | Other documents and evidence |

Evidence that any process agent referred to in Clause 14 of this Agreement and the Collateral Agreement has accepted its appointment.

| Option agreement | 19 |

Schedule 3

Form of Put Option Exercise Notice

| To: | DDC Enterprise Limited |

| From: | [insert name of Subscriber] (the “Subscriber”) |

| Date: | [●] |

Option Agreement between [●] and the Subscriber dated [●] 2025 (the “Option Agreement”)

| 1. | We refer to the Option Agreement. Terms defined in the Option Agreement have the same meanings in this Put Option Exercise Notice unless given a different meaning in this Put Option Exercise Notice. |

| 2. | [We note that a Put Option Exercise Event has occurred with respect to the [first (1st)/second (2nd)/third (3rd)] Anniversary. |

| 3. | Pursuant to Clause 2 of the Option Agreement, we are exercising our Put Option, subject to the following terms: |

| a. | Number of Relevant Securities proposed to be subject to such Put Option: [●] Shares |

| b. | Proposed Completion Date: [●], 202[●] |

| c. | Aggregate Exercise Price: [●] BTC (based on [●] Shares per BTC as determined in accordance with the definition of “Exercise Price”)] |

or

| 2. | [We note that an Event of Default (that is not a US Bankruptcy Filing Event) has occurred. |

| 3. | Pursuant to Clause 3 of the Option Agreement, you are hereby requested to purchase all the Relevant Securities held by us, subject to the following terms: |

| a. | Number of Relevant Securities: [●] Shares (being all Relevant Securities held by us) |

| b. | Proposed Completion Date: As soon as practicable but in no event later than [●], 202[●] |

| c. | Aggregate Exercise Price: [●] BTC (being all BTC standing to the credit of the Wallet A BTC Reserves)] |

| 4. | This Put Option Exercise Event is governed by Hong Kong law. |

[insert name of Subscriber]

By:

| Option agreement | 20 |

Execution Page

IN WITNESS whereof this Agreement has been duly executed and delivered as a deed by the DDC and signed by the Subscriber and Other Subscriber on the date first above written.

| DDC | ||

| EXECUTED AS A DEED | ) | |

| for and on behalf of | ) | |

| DDC ENTERPRISE LIMITED | ) | |

| ) | ||

| in the presence of: | ) | |

| ) | ||

| ) |

[Signature Page to Option Agreement (Valhalla)]

| The Subscriber | ||

| SIGNED by | ) | |

| ) | ||

| for and on behalf of | ) | |

| [●] | ) | |

| ) | ||

| in the presence of: | ) |