F-1/A: Registration statement for securities of certain foreign private issuers

Published on November 8, 2023

As filed with the Securities and Exchange Commission on November 8, 2023.

Registration Statement No. 333- 272689

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________

AMENDMENT NO. 6

TO

Form F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

_____________________________

DDC Enterprise Limited

(Exact name of Registrant as specified in its charter)

_____________________________

Not Applicable

(Translation of Registrant’s name into English)

_____________________________

|

Cayman Islands |

2000 |

Not Applicable |

||

|

(State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

Room 1601-1602, 16/F, Hollywood Centre

233 Hollywood Road

Sheung Wan, Hong Kong

Telephone: +852-2803-0688

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

_____________________________

Cogency Global Inc.

122 East 42nd Street, 18th Floor

New York, NY 10168

+1-800-221-0102

(Name, address, including zip code, and telephone number, including area code, of agent for service)

_____________________________

Copies of all communications, including communications sent to agent for service, should be sent to:

|

Lawrence S. Venick, Esq. |

Stephanie Tang, Esq. 88 Queensway Road Hong Kong SAR |

_____________________________

Approximate date of commencement of proposed sale to public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act:

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Commission, acting pursuant to such Section 8(a), may determine.

____________

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

|

PRELIMINARY PROSPECTUS (SUBJECT TO COMPLETION) |

DATED NOVEMBER 8, 2023 |

4,250,000 Class A Ordinary Shares

DDC Enterprise Limited

This is the initial public offering of our Class A ordinary shares (“Class A Ordinary Shares”). We are offering 4,250,000 of our Class A Ordinary Shares, par value $0.016 per share, on a firm commitment basis. The estimated initial public offering price is expected to be between US$9.50 and US$11.50 per share. Currently, no public market exists for our Class A Ordinary Shares. We have applied to list our Class A Ordinary Shares on the NYSE Group, or NYSE, under the symbol “DDC”. We cannot guarantee that we will be successful in listing our Class A Ordinary Shares on the NYSE Group; however, we will not complete this offering unless we are so listed.

Our ordinary shares will be classified into Class A Ordinary Shares and Class B Ordinary Shares. In respect of matters requiring shareholders’ vote, each Class A ordinary share is entitled to one vote, and each Class B ordinary share is entitled to ten votes.

We are both an “emerging growth company” and a “foreign private issuer” as defined under the U.S. federal securities laws and, as such, may elect to comply with certain reduced public company reporting requirements for this and future filings. See “Prospectus Summary — Implications of Being an Emerging Growth Company and a Foreign Private Issuer” for additional information. Investors are cautioned that you are buying shares of a shell company issuer incorporated in the Cayman Islands with operating subsidiaries in China and Hong Kong, investors will not hold direct equity investments in our China and Hong Kong operating subsidiaries. Our Class A ordinary shares offered in this prospectus are shares of our Cayman Islands holding company. See “Risk Factors — Risks Related to Doing Business in China and Hong Kong — Changes in China’s economic, political or social conditions or government policies could have a material adverse effect on our Company’s business and results of operations we may pursue in the future; — Uncertainties with respect to the PRC legal system, including uncertainties regarding the enforcement of laws, and sudden or unexpected changes in laws and regulations in China could adversely affect us; and — The Hong Kong legal system embodies uncertainties which could limit the legal protections available to us.”

We will not be a “controlled company” under the New York Stock Exchange Listed Company Manual post public offering.

Investing in our Class A Ordinary Shares is highly speculative and involves a significant degree of risk. Our Class A ordinary shares offered in this prospectus are shares of our Cayman Islands holding company. Although “we,” “us,” “our,” “our Group,” “the Group” or “our company” refer to DDC Enterprise Limited and its subsidiaries and the VIEs as a whole for ease of reference and discussion, investors should be aware that DDC Cayman and its subsidiaries do not have direct ownership in the VIEs, but rather exert control over and receive economic benefits from the VIEs through various contractual arrangements. In this prospectus where business activities or functions of the VIEs are described, specific references will be made to the relevant VIEs. We currently conduct our business through Shanghai DayDayCook Information Technology Co., Ltd, or SH DDC, Shanghai Lashu Import and Export Trading Co., Ltd., or SH Lashu, and Lin’s Group Limited, each an indirect wholly owned subsidiary of DDC Cayman, and a number of operating subsidiaries non-wholly and wholly owned by SH DDC. All of these operating subsidiaries are established under the laws of the PRC. During the two years ended December 31, 2021 and 2022, we had conducted part of our operations in China through (1) contractual arrangements with two variable interest entities and their consolidated entities (the “Weishi and City Modern VIEs”), namely, Shanghai Weishi Information Technology Co., Ltd., Shanghai City Modern Agriculture Development Co., Ltd., Shanghai City Vegetable Production and Distribution Co-op, Shanghai Jiapin Vegetable Planting Co-op, Shanghai Jiapin Ecological Agriculture Co-op, and (2) the Mengwei VIE. Through such contractual arrangements, we, through our indirect wholly-owned PRC subsidiary SH DDC, control and receive the economic benefits of the Weishi and City Modern VIEs without owning any direct equity interest in them. As of April 2022, such contractual arrangements with the Weishi and City Modern VIEs were terminated. In January 2021 and April 2023, we entered into contractual arrangements with Chongqing Mengwei Technology Co., Ltd. (“Mengwei Technology”), Liao Xuefeng, Chongqing Changshou District Weibang Network Co., Ltd. (“Weibang”), Chongqing Yizhichan Snack Food Electronic Commerce Service Department (“Yizhichan”) and Chongqing Ningqi E-commerce Co. Ltd. (“Ningqi”) to enable us to have the ability to control a number of online stores purchased from them since the titles of such online stores cannot be transferred to us due to the limitations from the policies of certain online platforms. These online stores were considered VIEs and SH DDC was the primary beneficiary. We refer to these online stores the “Mengwei VIE” throughout this prospectus. As of August 2023, all such contractual arrangements with regard to the Mengwei VIE have been terminated.

Recent statements by the Chinese government have indicated an intent to exert more oversight and control over offerings that are conducted overseas and/or foreign investments in China based issuers. Any future action by the Chinese government expanding the categories of industries and companies whose foreign securities offerings are subject to government review could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and could cause the value of such securities to significantly decline or be worthless.

Recently, the PRC government initiated a series of regulatory actions and made a number of public statements on the regulation of business operations in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas using a variable interest entity structure, adopting new measures to extend the scope of cybersecurity reviews, and expanding efforts in anti-monopoly enforcement. As there remains significant uncertainty in the interpretation and enforcement of relevant PRC cybersecurity laws and regulations, we cannot assure you that we would not be subject to cybersecurity review or investigations launched by PRC regulators. On December 28, 2021, the Cyberspace Administration of China (the “CAC”), and 12 other relevant PRC government authorities published the amended Cybersecurity Review Measures, which came into effect on February 15, 2022. The final Cybersecurity Review Measures provide that a “network platform operator” that possesses personal information of more than one million users and seeks a listing in a foreign country must apply for a cybersecurity review. Further, the relevant PRC governmental authorities may initiate a cybersecurity review against any company if they determine certain network products, services or data processing activities of such company affect or may affect national security. Through the contractual arrangements with Weishi, DDC SH had collected and possessed personal information of more than one million users. After the contractual arrangements with Weishi were terminated in April 2022, DDC SH still has been possessing this amount of personal information which are stored in mainland China. For purposes of the Cybersecurity Review Measures, we have applied for and completed the cybersecurity review with respect to our proposed overseas listing pursuant to the Cybersecurity Review Measures. See “Risk Factors — We may be liable for improper collection, use or appropriation of personal information provided by our customers.” Because these statements and regulatory actions are new, however, it is highly uncertain how soon legislative or administrative regulation making bodies in China will respond to them, or what existing or new laws or regulations will be modified or promulgated, if any, or the potential impact such modified or new laws and regulations will have on our daily business operations or our ability to accept foreign investments and list on an U.S. exchange.

On February 17, 2023, CSRC promulgated the Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Enterprises (the “Trial Measures”), which became effective on March 31, 2023. On the same date, the CSRC circulated Supporting Guidance Rules No. 1 through No. 5, Notes on the Trial Measures, Notice on Administration Arrangements for the Filing of Overseas Listings by Domestic Enterprises and relevant CSRC Answers to Reporter Questions (collectively, the “Guidance Rules and Notice”) on the CSRC’s official website. Under the Trial Measures, either direct or indirect overseas offering and listing by domestic companies shall fulfill the filing procedure with the CSRC with submitting relevant materials. Any overseas offering and listing made by an issuer that meets both the following conditions will be determined as indirect: (1) 50% or more of the issuer’s operating revenue, total profit, total assets or net assets as documented in its audited consolidated financial statements for the most recent accounting year is accounted for by domestic companies; and (2) the main parts of the issuer’s business activities are conducted in the Chinese Mainland, or its main places of business are located in the Chinese Mainland, or the senior managers in charge of its business operation and management are mostly Chinese citizens or domiciled in the Chinese Mainland. The determination as to whether or not an overseas offering and listing by domestic companies is indirect, shall be made on a substance over form basis. When certain circumstances happen, overseas offering and listing shall not be made. And If the intended overseas offering and listing necessitates a national security review, relevant security review procedures shall be completed according to law before the application for such offering and listing is submitted to any overseas parties such as securities regulatory agencies and trading venues. Pursuant to the Trial Measures and the Guidance Rules and Notice, initial public offerings or listings in overseas markets shall be filed with the CSRC within 3 working days after the relevant application is submitted overseas, while PRC domestic enterprises that have submitted valid applications for overseas offerings and listing but have not obtained the approval from the relevant overseas regulatory authority or overseas stock exchanges shall complete filings with the CSRC prior to their overseas offerings and listings. We have submitted the filing materials with the CSRC to fulfill the filing procedure with the CSRC as per requirement of the Trial Measures, and completed such proceeding in November 2023. However, there is no guarantee that we will continue to comply with the Trial Measures and if we fail to do so, we will be required to correct our behaviors, facing warnings and fines which amount will range from RMB1,000,000 to RMB10,000,000, and directly responsible personnel will also be warned and fined which amount will range from RMB500,000 to RMB5,000,000. Any failure of us to complete further filings or any other relevant regulatory

procedures in a timely manner will completely hinder our ability to offer or continue to offer our Class A Ordinary Shares, cause significant disruption to our business operations, and severely damage our reputation, which would materially and adversely affect our financial condition and results of operations and cause our Class A Ordinary Shares to significantly decline in value or become worthless. See “Risk Factors — The approval of the China Securities Regulatory Commission and other PRC governmental authorities provided under the M&A rules are not required in connection with this offering, and, if required, we cannot predict whether we will be able to obtain such approval. Except for the CSRC filing for this issuance and listing, we are not required to obtain any permission or approval from any Chinese authority to issue securities to foreign investors or in connection with this offering. We completed the CSRC filing in November 2023. However, there is no guarantee that we will continue to comply with additional filing requirements, if any, in the future.”

The Holding Foreign Companies Accountable Act, or the HFCAA, was enacted on December 18, 2020. In accordance with the HFCAA, trading in securities of any registrant on a national securities exchange or in the over-the-counter trading market in the United States may be prohibited if the Public Company Accounting Oversight Board (the “PCAOB”) determines that it cannot inspect or fully investigate the registrant’s auditor for three consecutive years beginning in 2021, and, as a result, an exchange may determine to delist the securities of such registrant. On December 23, 2022, the Accelerating Holding Foreign Companies Accountable Act, or the AHFCAA, was enacted, which amended the HFCAA by reducing the aforementioned inspection period from three to two consecutive years, thus reducing the time period before our securities may be prohibited from trading or delisted if our auditor is unable to meet the PCAOB inspection requirement. Pursuant to the HFCAAt, the PCAOB issued a Determination Report on December 16, 2021 which found that the PCAOB is unable to inspect or investigate completely registered public accounting firms headquartered in: (1) mainland China of the People’s Republic of China because of a position taken by one or more authorities in mainland China; and (2) Hong Kong, a Special Administrative Region and dependency of the PRC, because of a position taken by one or more authorities in Hong Kong. In addition, the PCAOB’s report identified the specific registered public accounting firms which are subject to these determinations. Our registered public accounting firm, KPMG Huazhen LLP, is headquartered in mainland China or Hong Kong and was identified in this report as a firm subject to the PCAOB’s determination. On December 15, 2022, the PCAOB Board determined that the PCAOB was able to secure complete access to inspect and investigate registered public accounting firms headquartered in mainland China and Hong Kong and voted to vacate its previous determinations to the contrary. However, whether the PCAOB will continue to be able to satisfactorily conduct inspections of PCAOB-registered public accounting firms headquartered in mainland China and Hong Kong is subject to uncertainties and depends on a number of factors out of our and our auditor’s control. The PCAOB continues to demand complete access in mainland China and Hong Kong moving forward and is making plans to resume regular inspections in early 2023 and beyond, as well as to continue pursuing ongoing investigations and initiate new investigations as needed. The PCAOB has also indicated that it will act immediately to consider the need to issue new determinations with the HFCAA if needed. If the PCAOB is unable to inspect and investigate completely registered public accounting firms located in China and we fail to retain another registered public accounting firm that the PCAOB is able to inspect and investigate completely in 2023 and beyond, or if we otherwise fail to meet the PCAOB’s requirements, our Class A ordinary Shares will be delisted from the NYSE Group and will not be permitted for trading over the counter in the United States under the HFCAA and related regulations. On December 2, 2021, the SEC adopted final amendments implementing the disclosure and submission requirements under the Holding Foreign Companies Accountable Act, pursuant to which the SEC will (i) identify an issuer as a “Commission-Identified Issuer” if the issuer has filed an annual report containing an audit report issued by a registered public accounting firm that the PCAOB has determined it is unable to inspect or investigate completely because of the position taken by the authority in the foreign jurisdiction and (ii) impose a trading prohibition on the issuer after it is identified as a Commission-Identified Issuer for three consecutive years. See “Risk Factors — The recent enactment of the Holding Foreign Companies Accountable Act may result in de-listing of our securities.”

As a holding company, we may rely on dividends and other distributions on equity paid by our PRC subsidiaries for our cash and financing requirements. If any of our PRC subsidiaries incurs debt on its own behalf in the future, the instruments governing such debt may restrict their ability to pay dividends to us. As at the date of this prospectus, neither of our direct wholly or non-wholly owned subsidiaries nor the VIEs have made any dividends or other distributions to our holding company and the holding company has not made any dividends or distributions to any investors including U.S. investors as of the date of this prospectus. The holding company, its subsidiaries, and VIEs do not have any plan to distribute dividend or settle amounts owed under the prior or current contractual agreements in the foreseeable future. However, to the extent cash/assets in the business is in PRC/Hong Kong or our PRC/Hong Kong entity, the funds/assets may not be available to fund operations or for other use outside of the PRC/Hong Kong due to interventions in or the imposition of restrictions and limitations on the ability of us, our subsidiaries or the VIEs by the PRC government to transfer cash/assets. See “Transfer of Cash Through our Organization”, and “Risk Factors — Risks Related to Doing Business in China and Hong Kong — PRC regulation of loans to and direct investment in PRC entities by offshore holding companies and governmental control of currency conversion may delay us from using part of the proceeds of this offering to make loans or additional capital contributions to our PRC subsidiaries, which could materially and adversely affect our liquidity and our ability to fund and expand our business” and “Restrictions on currency exchange may limit our ability to utilize our revenues effectively.” In the future, cash proceeds raised from overseas financing activities, including this offering, may be transferred by us to our PRC subsidiaries via capital contribution or shareholder loans, as the case may be. We currently don’t have any cash management policies and procedures in place that dictate how funds are transferred through our organization. Rather, the funds can be transferred in accordance with the applicable PRC laws and regulations. As of the date of this prospectus, no cash transfer has been made among the holding company, its subsidiaries and VIE.

Before buying any shares, you should carefully read the discussion of material risks of investing in our Class A Ordinary Shares in “Risk Factors” beginning on page 39 of this prospectus.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

|

PER SHARE |

TOTAL |

|||||

|

Initial public offering price |

$ |

[ ] |

$ |

[ ] |

||

|

Underwriting discounts and commissions(1)(2) |

$ |

[ ] |

$ |

[ ] |

||

|

Proceeds, before expenses, to us |

$ |

[ ] |

$ |

[ ] |

||

____________

(1) Assuming an initial public offering price of US$[ ] per Class A Ordinary Share, being the mid-point of the estimated range of the initial public offering price.

(2) For a description of compensation payable to the underwriter, see “Underwriting” beginning on page 208.

We expect our total cash expenses for this offering (including cash expenses payable to our underwriters for their out-of-pocket expenses) to be approximately $[ ], exclusive of the above discounts and commissions. In addition, we will pay additional items of value in connection with this offering that are viewed by the Financial Industry Regulatory Authority, or FINRA, as underwriting compensation. These payments will further reduce proceeds available to us before expenses. See “Underwriting.”

This offering is being conducted on a firm commitment basis. The underwriters are obligated to take and pay for all of the shares if any such shares are taken. We have granted the underwriters an option for a period of thirty (30) days after the closing of this offering to purchase up to 15% of the total number of our Class A Ordinary Shares to be offered by us pursuant to this offering (excluding shares subject to this option), solely for the purpose of covering over-allotments, at the initial public offering price less the underwriting discounts and commissions. If the Underwriter exercises the option in full, the total underwriting discounts and commissions payable will be $[ ] based on an assumed initial public offering price of $[ ] per Class A Ordinary Shares, and the total proceeds to us, before expenses, will be $[ ]. If we complete this offering, net proceeds will be delivered to us on the closing date.

The underwriters expect to deliver the Class A Ordinary Shares against payment as set forth under “Underwriting”, on or about , 2023.

|

CMB International |

The Benchmark Company |

|||||

|

Maxim Group |

Freedom Capital Markets |

|||||

|

Guotai Junan International |

Eddid Financial |

Tiger Brokers |

||||

The date of this prospectus is , 2023.

|

Page |

||

|

1 |

||

|

39 |

||

|

88 |

||

|

89 |

||

|

90 |

||

|

91 |

||

|

92 |

||

|

96 |

||

|

98 |

||

|

101 |

||

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

104 |

|

|

129 |

||

|

132 |

||

|

156 |

||

|

169 |

||

|

176 |

||

|

179 |

||

|

183 |

||

|

199 |

||

|

201 |

||

|

208 |

||

|

220 |

||

|

221 |

||

|

221 |

||

|

222 |

||

|

224 |

||

|

F-1 |

We are responsible for the information contained in this prospectus and any free writing prospectus we prepare or authorize. We have not, and the underwriters have not, authorized anyone to provide you with different information, and we and the underwriters take no responsibility for any other information others may give you. We are not, and the underwriters are not, making an offer to sell our Class A Ordinary Shares in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front cover of this prospectus, regardless of the time of delivery of this prospectus or the sale of any Class A Ordinary Shares.

For investors outside the United States: Neither we nor the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction, other than the United States, where action for that purpose is required. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the Class A Ordinary Shares and the distribution of this prospectus outside the United States.

We are incorporated under the laws of the Cayman Islands and a majority of our outstanding securities are owned by non-U.S. residents. Under the rules of the U.S. Securities and Exchange Commission, or the SEC, we currently qualify for treatment as a “foreign private issuer.” As a foreign private issuer, we will not be required to file periodic reports and financial statements with the Securities and Exchange Commission, or the SEC, as frequently or as promptly as domestic registrants whose securities are registered under the Securities Exchange Act of 1934, as amended, or the Exchange Act.

Until and including , 2023 (twenty-five (25) days after the date of this prospectus), all dealers that buy, sell or trade our Class A Ordinary Shares, whether or not participating in this offering, may be required to deliver a prospectus. This delivery requirement is in addition to the obligation of dealers to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

i

CONVENTIONS THAT APPLY TO THIS PROSPECTUS

Unless we explicitly state otherwise or the context otherwise indicates clearly, all references in this prospectus to “we,” “us,” “our,” “our Group,” “the Group” or “our company” refer to DDC Enterprise Limited and its subsidiaries and the VIEs.

The “Company” or “DDC Cayman” refers to DDC Enterprise Limited.

“HKD” or “HK$” refers to the legal currency of Hong Kong.

“Hong Kong” refers to Hong Kong Special Administrative Region of the People’s Republic of China.

“Macau” refers to Macau Special Administrative Region of the People’s Republic of China.

“RMB” or “Renminbi” refers to the legal currency of China.

“mainland China,” “PRC” or “China” refers to the People’s Republic of China, excluding, for the sole purpose of this prospectus, Hong Kong, Macau and Taiwan, unless the context otherwise indicates.

“paid customers”, with respect to a certain point of time, refers to the Company’s current and past customers who had, as of that point of time, purchased product or service from the Company.

“Prospectus” refers to the public offering prospectus unless we explicitly state otherwise or the context otherwise indicates clearly.

“$” or “U.S. dollars” or “USD” refers to the legal currency of the United States.

“Share Consolidation” means the consolidation of every 16 authorized Company shares of each class with par value of $0.001 into one share of the same class with a par value of US$0.016 each, which will be effectuated upon shareholder approval before our initial public offering.

We have made rounding adjustments to some of the figures included in this prospectus. Accordingly, numerical figures shown as totals in some tables may not be an arithmetic aggregation of the figures that preceded them.

Unless the context indicates otherwise, all information in this prospectus (except for pages F-1 to F-37) assumes (i) no exercise by the underwriters of their over-allotment option and no exercise of the Underwriter Warrants and (ii) a 1-for-16 Share Consolidation of all classes of our shares which will be effectuated upon shareholder approval before our initial public offering.

Our business is primarily conducted in China, and the financial records of our subsidiaries in Asia are maintained in USD, and our functional currency is USD. Our consolidated financial statements are presented in U.S. dollars. We use U.S. dollars as the reporting currency in our consolidated financial statements and in this prospectus.

TRADEMARKS, SERVICE MARKS AND TRADE NAMES

This prospectus includes trademarks, tradenames and service marks, certain of which belong to us, including the DayDayCook logo, and others that are the property of other organizations. Solely for convenience, the trademarks, service marks, logos and trade names referred to in this prospectus are without the ® and ™ symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensors to these trademarks, service marks and trade names.

This prospectus contains additional trademarks, service marks and trade names of others, which are the property of their respective owners. All such trademarks, service marks and trade names appearing in this prospectus are, to our knowledge, the property of their respective owners. We do not intend our use or display of other companies’ trademarks, service marks, copyrights or trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

ii

PUBLIC OFFERING PROSPECTUS SUMMARY

The following summary highlights information contained elsewhere in this prospectus and does not contain all of the information you should consider before investing in our Class A Ordinary Shares. You should read the entire prospectus carefully, including “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and our consolidated financial statements and the related notes thereto, in each case included in this prospectus. You should carefully consider, among other things, the matters discussed in the section of this prospectus titled “Business” before making an investment decision. This prospectus contains information from an industry report commissioned by us and prepared by Frost & Sullivan, an independent research firm, to provide information regarding our industry. We refer to this report as the Frost & Sullivan Report.

Unless otherwise indicated, all share amounts and per share amounts in this prospectus (except for pages F-1 to F-137) have been presented giving effect to the Share Consolidation of our authorized shares at a ratio of 1-for-16 shares which will be effectuated upon shareholder approval before our initial public offering.

Our Mission

Our mission is to inspire others to enjoy cooking as part of a quality lifestyle and culture. We are driven to improve lives by creating easy-to-cook, delicious, and healthy meal solutions. It is our vision to create fun experiences and inspirations in every kitchen.

Overview

We are a food innovator with leading content driven (i.e. using content to reach and engage target customers) consumer brands offering easy, convenient ready-to-heat (“RTH”), ready-to-cook (“RTC”), ready-to-eat (“RTE”) and Plant-based meal products (i.e. meal products consisting largely or solely of vegetables, fruits, grains and other foods derived from plant-based protein, rather than animal protein) while promoting healthier lifestyle choices to our predominately Millennial and Generation Z (“GenZ”) customer-base. We are also engaged in the provision of advertising services.

We were founded in Hong Kong in 2012 by Ms. Norma Ka Yin Chu, a highly regarded entrepreneur and a true cooking enthusiast, as an online platform which distributed food recipes and culinary content. Subsequently, we further expanded our business to provide advertising services to brands that wish to place advertisements on our platform or video content. In 2015, we entered the Mainland China market through the establishment of Shanghai DayDayCook Information Technology Co., Ltd (“SH DDC”) to engage in technology development of computer software, food circulation and advertising production in China. In 2017, we started expanded our business from content creation to content commerce. Later in 2019, we extended our business to include the production and sale of, among others, own-branded RTH, RTC convenient meal solution products.

As of June 30, 2023, our main product categories include (i) own-branded RTH products — typically semi-cooked meals with some but minimal preparation required ahead of serving, (ii) own-branded RTC products — ready to be consumed within 8 to 15 minutes with some additional cooking preparation, (iii) own-branded RTE products — typically pre -cooked meals that are ready to serve with minimal level of additional preparation, which includes our plant-based meal products localized for the palate of an Asian consumer, and (iv) private label products (i.e. third-party branded food products).

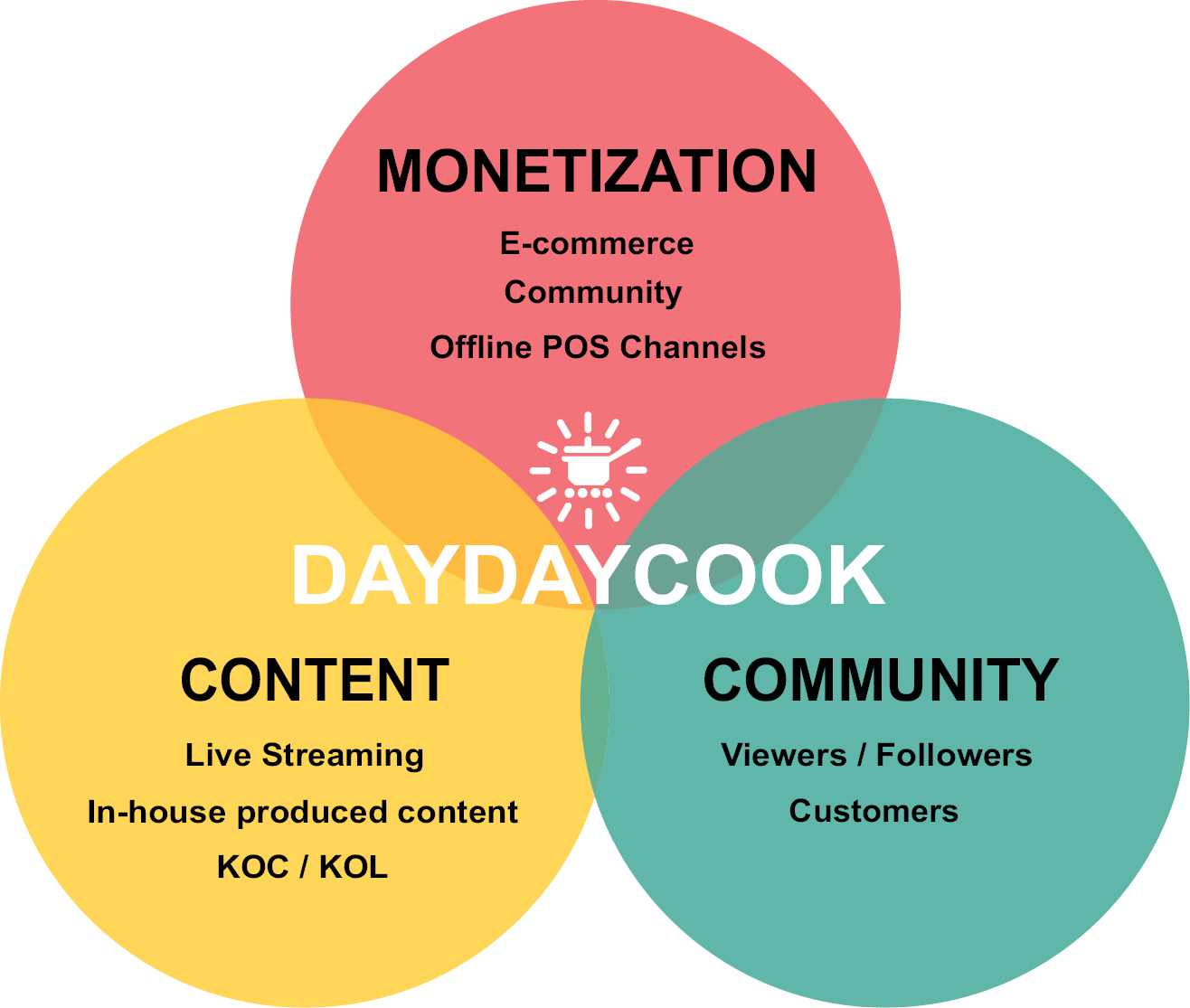

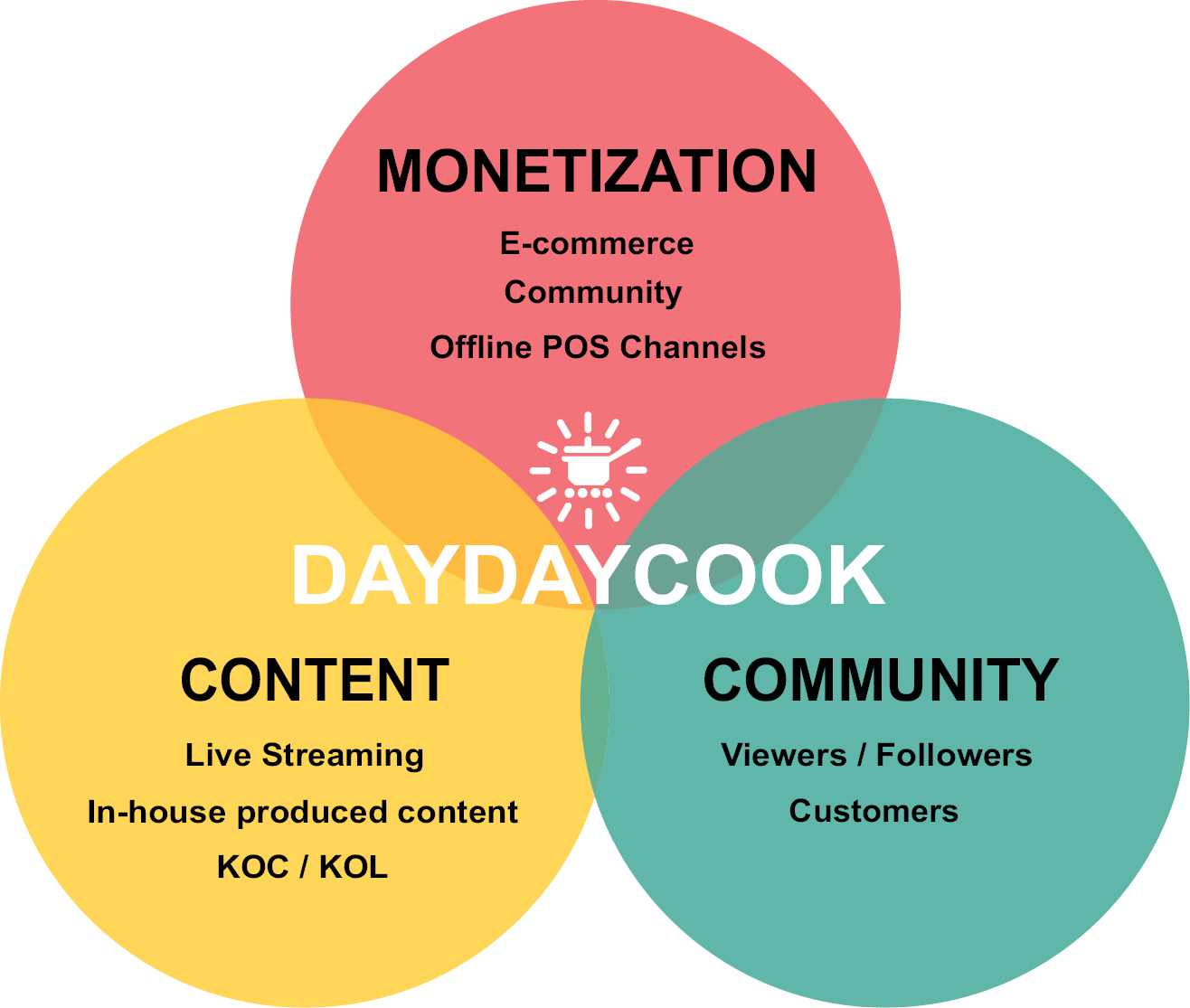

Business Model

Our omni-channel (online and offline) sales, end-to-end (“E2E”) product development and distribution strategy, and data analytics capabilities enable us to successfully identify, assess, and pivot to cater to changing consumer preferences and trends across multiple customer segments and price-points. From a product distribution standpoint, we have created a network of direct-to-customer (“D2C”), retailer, and wholesaler sale options.

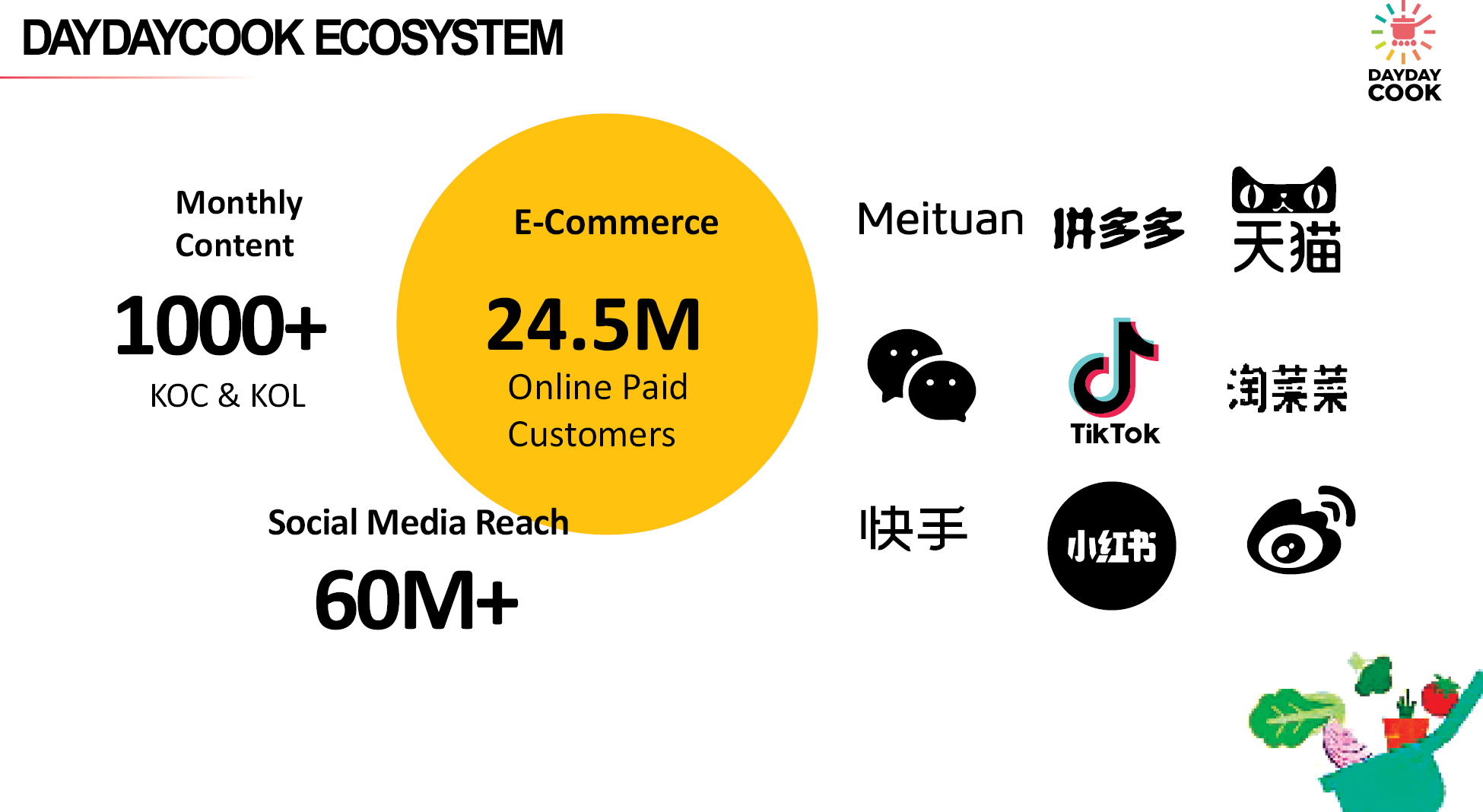

• We leverage (i) large China-based e-commerce platforms e.g., Tmall, JD.com, Pinduoduo, (ii) leading livestreaming, video-sharing, content-marketing platforms e.g., ByteDance (TikTok and sister-app Douyin), Bilibili, Weibo, Little Red Book (小红书), Kuaishou etc., and (iii) online-merged-offline (OmO) group-buy platforms e.g., Meituan-Dianping to drive online sales. We would cooperate with third-party online distributors on these e-commerce platforms to promote and sell our products.

1

• We have access to a network of offline point-of-sales (“POS”) through partnerships with (i) convenience stores e.g., 7/11, Lawson etc., (ii) multi-national retail corporations e.g., Carrefour, Hema etc., (iii) boutique supermarket chains e.g., Ole’, G-Super etc., and (iv) various corporate partnerships e.g., Towngas to distribute and sell our products.

• We operate in the Mainland China market but are actively expanding into international markets including but not limited to the United States and Canada.

• We own multiple brands in our portfolio that provide convenient meal solution products to a wide range of consumers. We are actively looking for acquisition opportunities in complimentary brands in the Asian food and cooking categories as well as targets that can strengthen the company’s network of sales distribution.

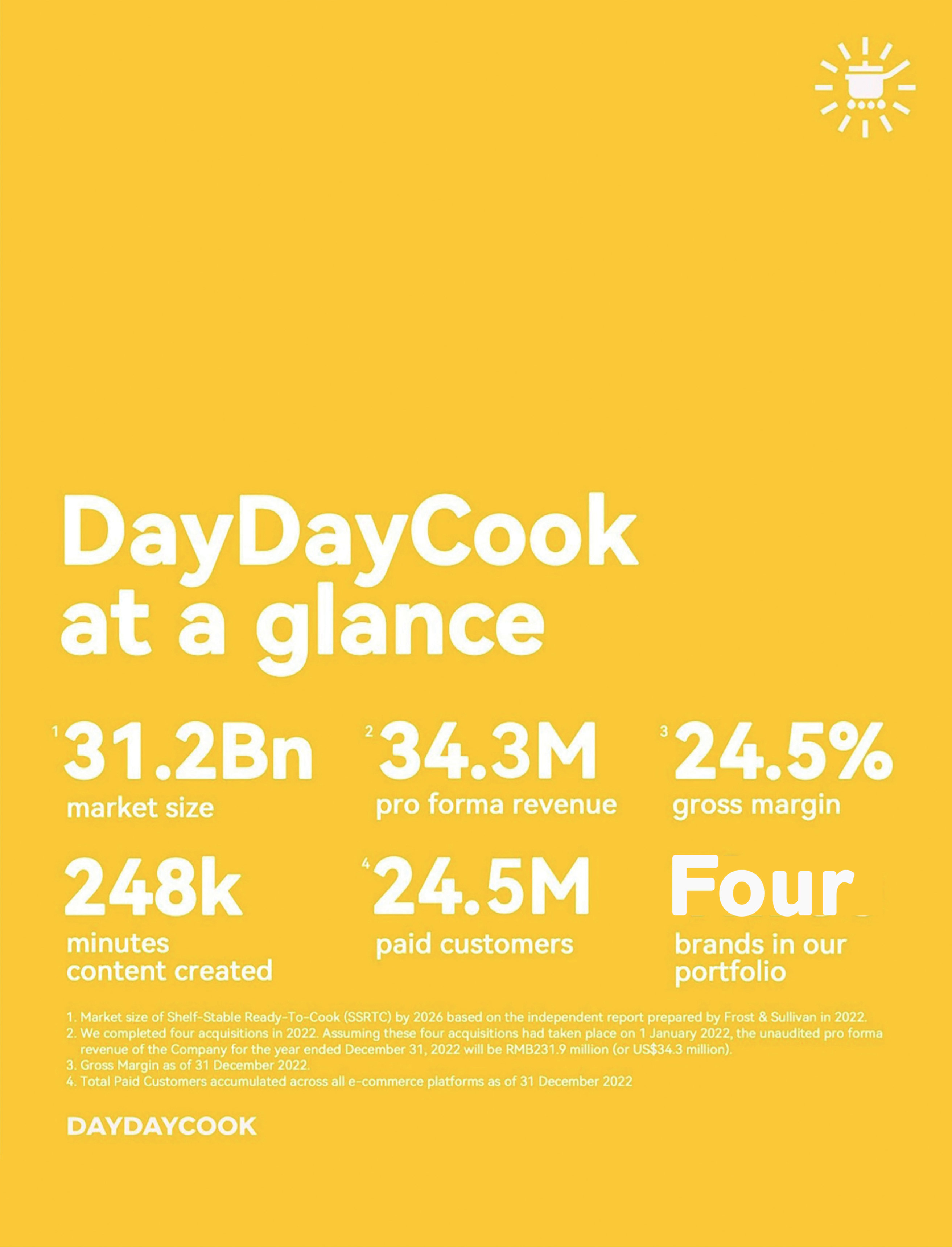

As of June 30, 2023, we had 24.5 million paid customers. Around 69% of our followers on social media & video platforms are GenZ. 50% of customers are from the Eastern & Southern parts of China, and 86% are female. In particular, we believe that our products appeal to GenZ because (1) when compared to older age groups, GenZ generally do not want to spend a long time cooking at home and they value cost effective options like RTC, RTH and RTE meals due to the ease of cooking that RTC, RTH and RTE products provide; (2) we promote our products mainly through social media, the audience of which are mainly the GenZ population; (3) we mainly sell our products through e-commerce platforms, including livestreaming e-commerce, the customers demographics of which are dominated by GenZ; (4) plant-based diets have progressed from a food trend to a globally recognized lifestyle which GenZ is more willing to embrace. The average age of a viewer engaging with our products or marketplace is younger than 30 years old. From 2018 to June 2023, we have a content library with more than 247,874 minutes of in-house created content.

For the six months ended June 30, 2023, we recorded RMB89.4 million (or US$12.3 million) in total revenue compared to RMB66.8 million for the six months ended June 30, 2022, representing a 33.9% increase. Subsequent to June 30, 2023, we completed two acquisitions. Assuming these two acquisitions had taken place on 1 January 2023, the unaudited pro forma revenue of the Company for the six months ended June 30, 2023 would be RMB123.6 million (or US$17.0 million). For the six months ended June 30, 2023, our gross margin increased to 26.2% versus 20.2% for the six months ended June 30, 2022.

For the year ended December 31, 2022, we recorded RMB179.6 million (or US$24.8 million) in total revenue. This drop in revenue was largely a result of negative impact from extended zero-covid policy in China which led to massive disruptions in the company’s e-commerce operations. In the face of this challenge, we completed four acquisitions in 2022

2

to speed up the diversification of revenue streams as well as aggressive improvement on overall cost structure. Assuming these four acquisitions had taken place on 1 January 2022, the unaudited pro forma revenue of the Company for the year ended December 31, 2022 will be RMB231.9 million (or US$32.0 million). Equally important, our focus has been on improving the overall cost structure of the business when facing Covid and inflation challenges. For the year ended December 31, 2022, our gross profit margin increased to 24.5% versus 17.8% for the year ended December 31, 2021.

As the company continues to execute on its M&A strategy, which primarily focuses on the acquisition of complimentary brands in the Asian food and cooking categories as well as sales channel access, in April 2023, we entered into a purchase agreement to acquire 51% equity interest of Shanghai Yuli Development Limited (“Yuli”), to add new sales channels in Ready-To-Cook and Ready-To-Eat product categories; also in May 2023, we entered into a purchase agreement to acquire “Nona Lim”, an Asian food brand based in San Francisco, USA. The brand sells Ready-To-Cook Asian noodle meal kits and a variety of soup bases to its customers through an established distribution network in the United States, including major retailers such as Whole Foods Market, Target, and Kroger. The acquisitions of Yuli and Nona Lim were completed in the third quarter of 2023.

We have incurred a loss from operations, had net cash used in operating activities, net current liabilities and an accumulated deficit. In addition, our auditor’s report includes an explanatory paragraph expressing substantial doubt about our ability to continue as a going concern.

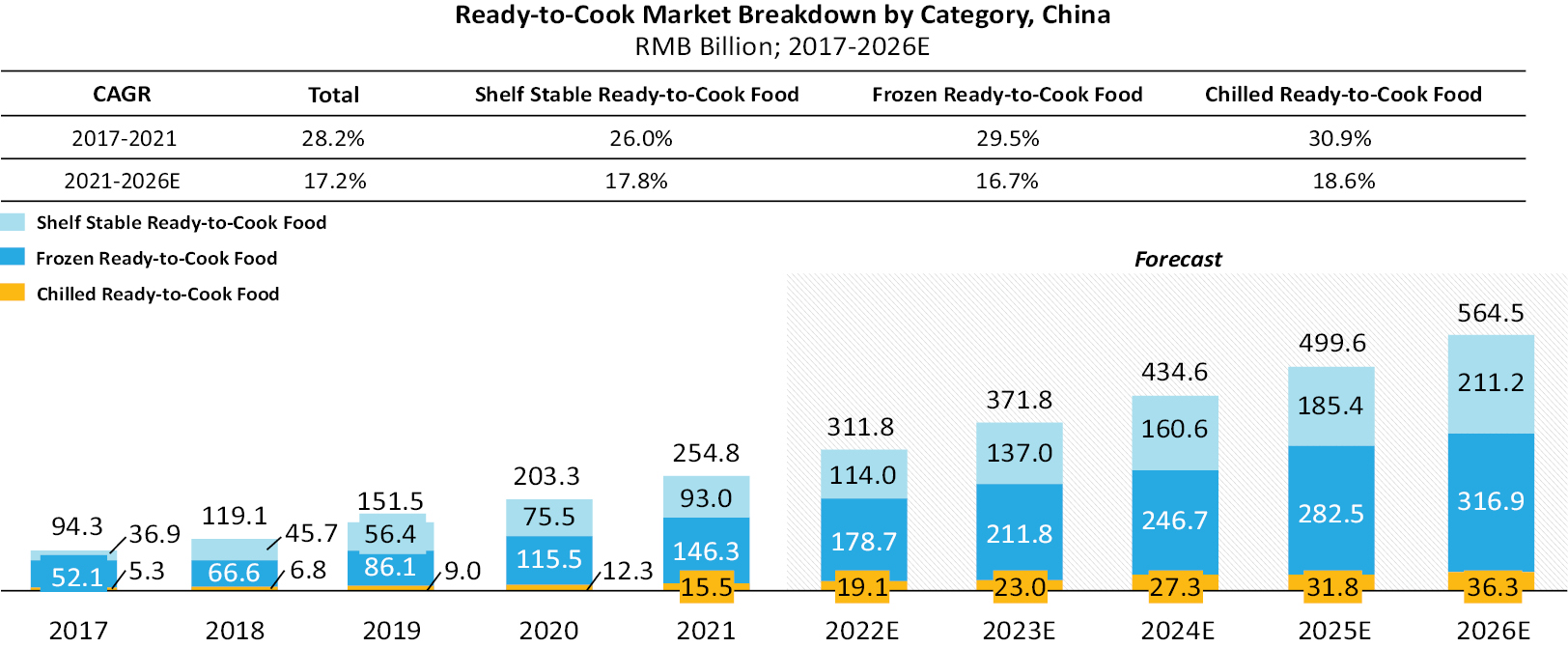

Our Industry

We compete primarily in the convenient meal solutions market providing RTE, RTC and RTH products to our customers. With (i) the proliferation of food delivery service options, (ii) a shift in customer preference and behavior away from home-cooked to convenience, and (iii) an increase in GDP per capita/overall disposable income (both in our target demographic and in-general) the demand for convenient meal solution products including RTC/RTE products has increased significantly. Customers have also become more discerning and expect RTC/RTH/RTE products to be of a high quality, have a higher nutritional value, and taste better when compared with other processed or semi-processed food product categories. Typically, RTC and RTE meals are made using high-quality and seasonal ingredients with full traceability at every stage of the food chain and a focus on nutritional value and maintaining a balanced diet is factored into the recipe and product R&D process.

COVID-19 has accelerated the shift to e-commerce and the need to develop and professionalize China’s cold chain transport infrastructure. The logistics industry is benefiting from the proliferation of professional third-party logistics service providers as well as improvements in preservation/storage, information logistics, analysis, and distribution technology. As a result of improvements in logistical infrastructure and the scale of the distribution network, the RTC and RTE industry has been able to expand its geographical reach, improve product delivery efficiency, and guarantee food safety and maintain quality over larger distances.

Internationally, the development history of mature overseas RTC and RTE markets nurtures an extensive customer base of RTC and RTE products. The COVID-19 pandemic further stimulates such demands in overseas markets as it alters people’s lifestyle and increases health consciousness, especially in Southeast Asia. In addition, with the development of those mature RTC markets, an increasing number of customers are in pursuit of a healthier lifestyle and start to favor healthier ready-to-cook products instead of RTC products of high calories as well as healthier ready-to-eat products instead of junk food. Chinese companies in the RTC and RTE industry, because of their well-established value chains, are able to offer RTC and RTE products of competitive prices in markets like North America and Europe despite the additional logistic expenses. Thus, Chinese companies that are actively seeking international expansion opportunities are well positioned to gain share in the global RTC and RTE market.

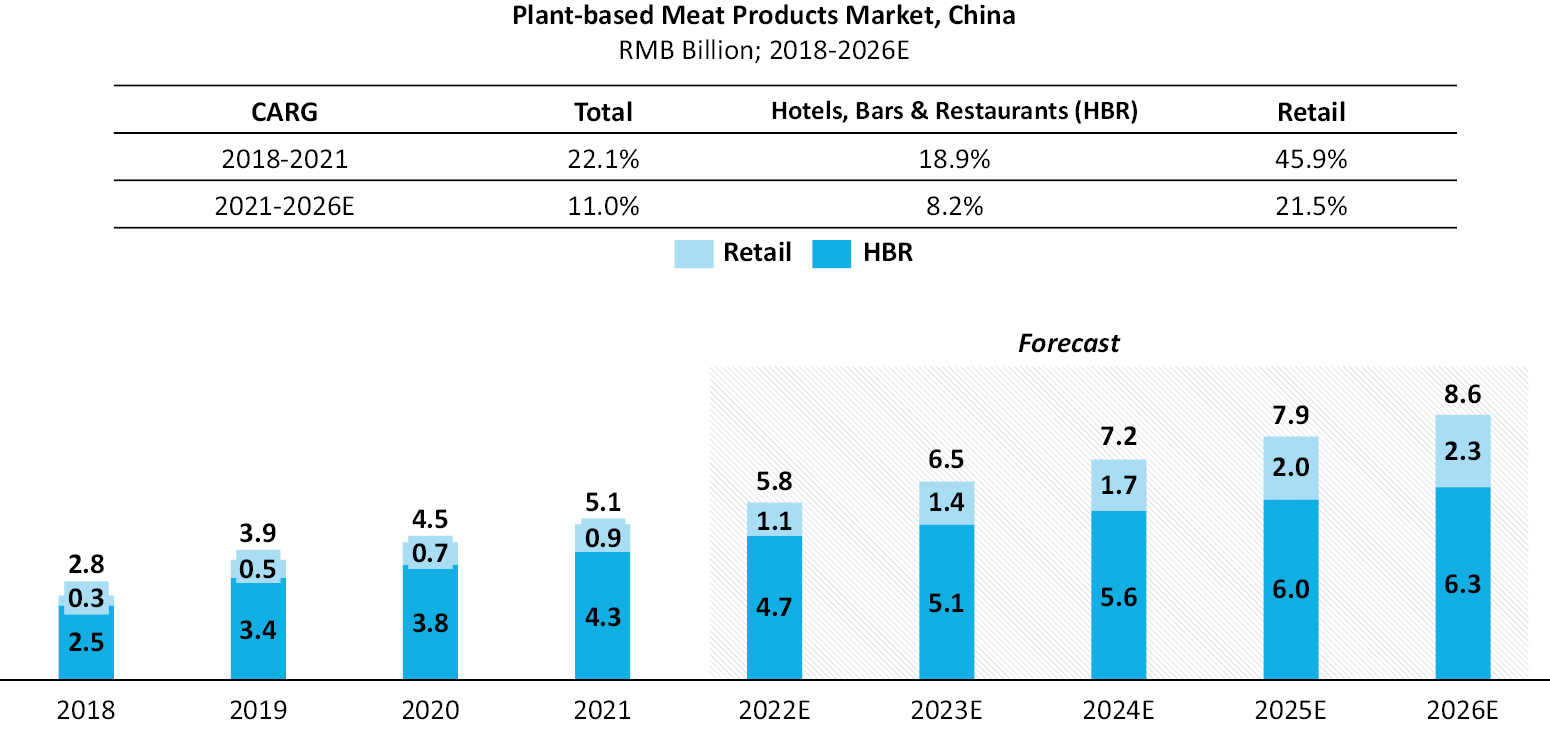

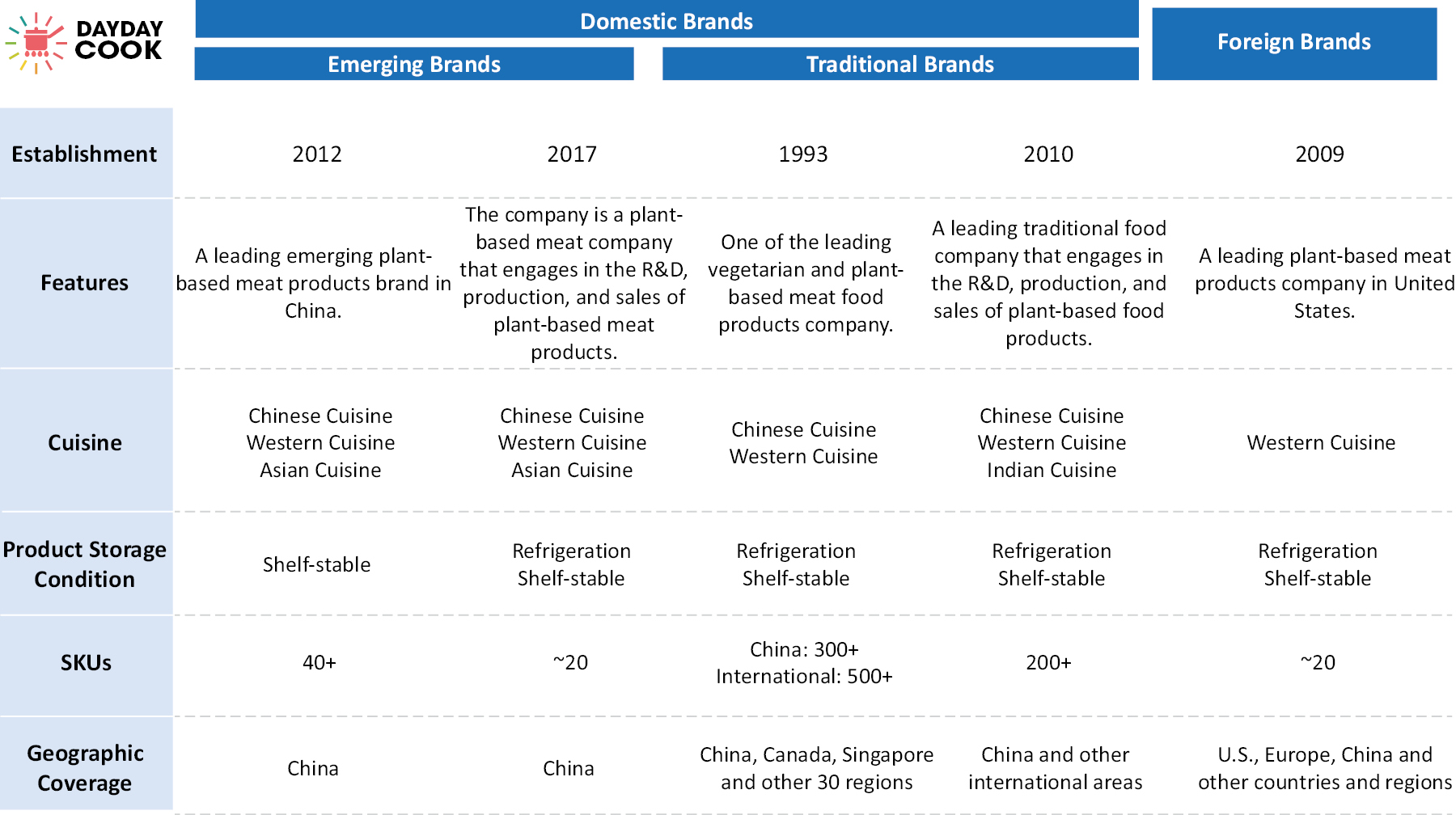

Plant-based products are a nascent Fast-Moving Consumer Goods (“FMCG”) category in China. Some Chinese brands have recently emerged as strong competitors to international incumbents. Younger individuals are the target demographic of companies offering plant-based substitutes/alternatives. Many new brands have been able to penetrate the younger customer segment by adopting an omnichannel strategy and by offering good quality, varied product offerings at a reasonable price-point.

Around the globe, the public has been paying more attention to environmental and natural resources protection over the past decades. The technology and production of plant-based meat has also experienced rapid development. Benefiting from the mature production technology of plant-based meat, foreign brands, when compared with Chinese brands, have obvious advantages in imitation of meat flavor and texture. However, limiting to product categories, flavor localization, stock-keeping unit (“SKU”) quantity, and high price, it is difficult for them to seize significant business opportunities in Chinese market. Compared to foreign brands, domestic brands pay more attention to

3

recipe R&D and introduce various plant-based meat food products into the market, ranging from Western cuisine to Chinese cuisine, including but not limited to Panini, pizza, hamburgers, braised rice, pies, noodles, and other products. Finally, the processed volume of soybean protein and pea protein in China contributes nearly half of the global volume every year, which provides a significant advantage in raw materials for domestic plant-based meat food products companies.

Our Competitive Strengths

We believe the following competitive strengths differentiate us from our competitors and will continue to contribute to our success:

Leading Content Driven Consumer Brand in China that Possess a Loyal Customer Base, and Clear Alignment with Consumer Trends

We are a food innovator with leading content-driven lifestyle brands for young food lovers, especially GenZ customers in China. We believe that our RTH, RTC, RTE, and plant-based meal products portfolio aligns with broader Fast-Moving-Consumer-Goods trends and shifts in consumer behavior. Our products, brand, and mission resonate strongly with our GenZ customer base who seek high quality and nutritional food products that are sustainably and ethically sourced. As of June 30, 2023, more than 24.5 million consumers had purchased our products via one or more e-commerce platforms.

Track Record of Innovation

We allocated and will continue to allocate significant resources to product innovation for our RTC and RTE products. We typically launch new products on a quarterly basis. To position us as a leader in the convenient RTC and RTE categories, we partnered with PFI Foods in the third quarter of 2020, cooperated with Meta Meat in 2021, both companies being leading plant-based meat manufacturers in mainland China, to develop a line of plant-based food products. In 2023, we have also launched a partnership with Nestle China using their Harvest Gourmet brand of plant-based meat to bring the first-ever RTC products to market.

In addition, the company is building a library of new product concepts and recipes, ready for further development and testing. We believe that we excel at identifying ingredient combinations, and flavor profiles that appeal to the palate of young Asian consumers. Leveraging our innovation capabilities, our experience in the Chinese markets and our deep understanding of the palate of Asian consumers, we are confident that when executing our international market expansion plan, we can introduce new product innovation and develop food products that appeal to other Asian communities and potentially an even wider audience on the global stage.

Omni-Channel and Multi-Faceted Sales & Distribution Strategy

The Company’s core distribution strategy is to balance the revenue mix of online sales and offline sales. By leveraging the power of e-commerce, we tap into the growing digital market while providing various meal solutions to our consumers all around China. Simultaneously, we maintain a strong presence in physical retail through distributors, ensuring accessibility and brand visibility. This balanced distribution strategy enables us to capture diverse customer segments, optimize sales channels, and mitigate risks associated with concentration on a single distribution channel. In 2022, due to the impact of Covid outbreak in mainland China, we encountered difficult meeting our customers’ need online. As a result, about 81% and 61% of our revenue came from Offline consumer product sales for the six months ended June 30, 2023 and for the year ended December 31, 2022 respectively.

Our omni-channel (both offline and online) strategy spans (i) popular e-commerce channels e.g., Taobao and JD.com, (ii) social and content platforms e.g., TikTok, Kuaishou, Bilibili, and WeChat, and (iii) community group buying platforms e.g., Meituan-Dianping. From 2019 to March 2023, our online sales network including, among others, Tmall, JD.com, and China Pinduoduo have attracted 107.18 million visitors and for the six months ended June 30, 2023, and for the year ended December 31, 2022, generated online consumer product sales of RMB16.4 million (or US$2.3 million) and RMB67.0 million (or US$9.2 million) respectively. In 2023, we increased our offline retail distribution network and have worked with 709 distributing partners.

We will continue to focus on bringing our customers the best quality Asian meal solution, by implementing a balanced distributing strategy. In 2023, the company’s forecasted online sales will account for 50% of total sales, while offline sales will account for the remaining half.

4

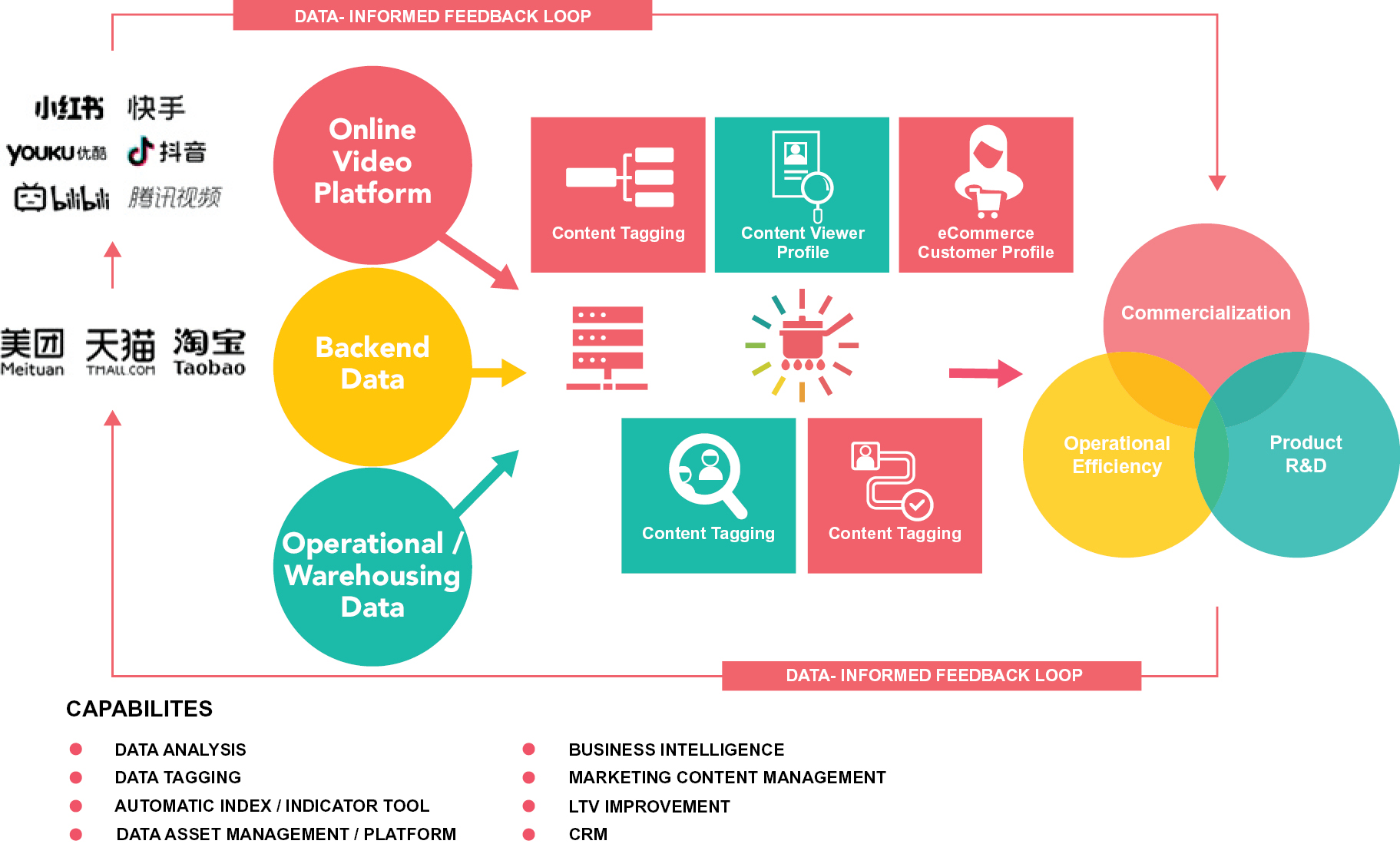

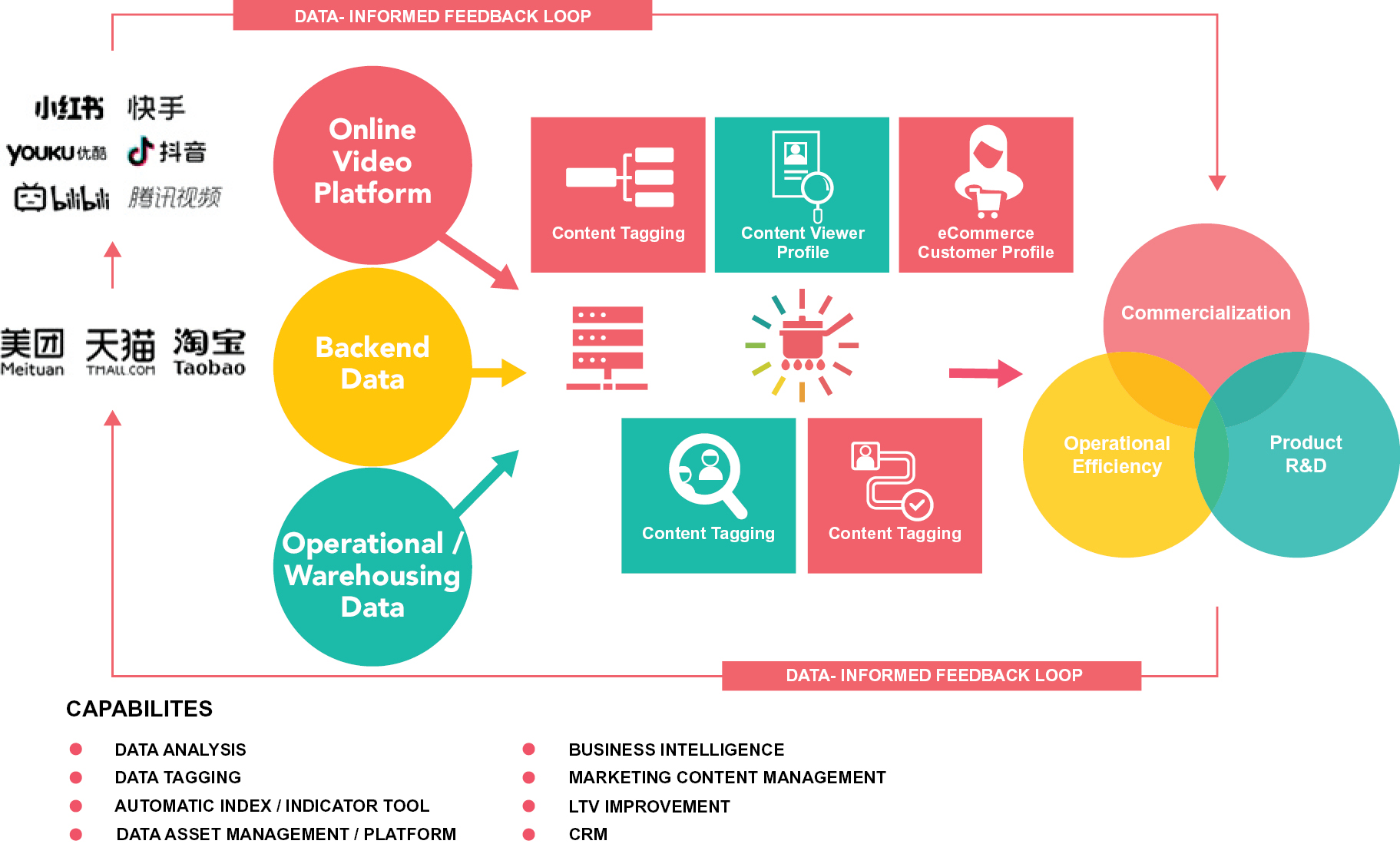

Customer Engagement Analytics, Customer Service, and Real-Time (“RT”) Feedback Capabilities

We analyze transaction data, collect customer feedbacks through one or more channels, and engage in customer engagement analytics. This helps to (i) streamline the product development lifecycle and reduce the risk of a customer-product mismatch, (ii) uncover new (sub) product categories and/or potential bundling and/or up and cross-sell opportunities within the existing product portfolio, (iii) strengthen our brand image, and (iv) improve customer “stickiness” by providing customers with a forum.

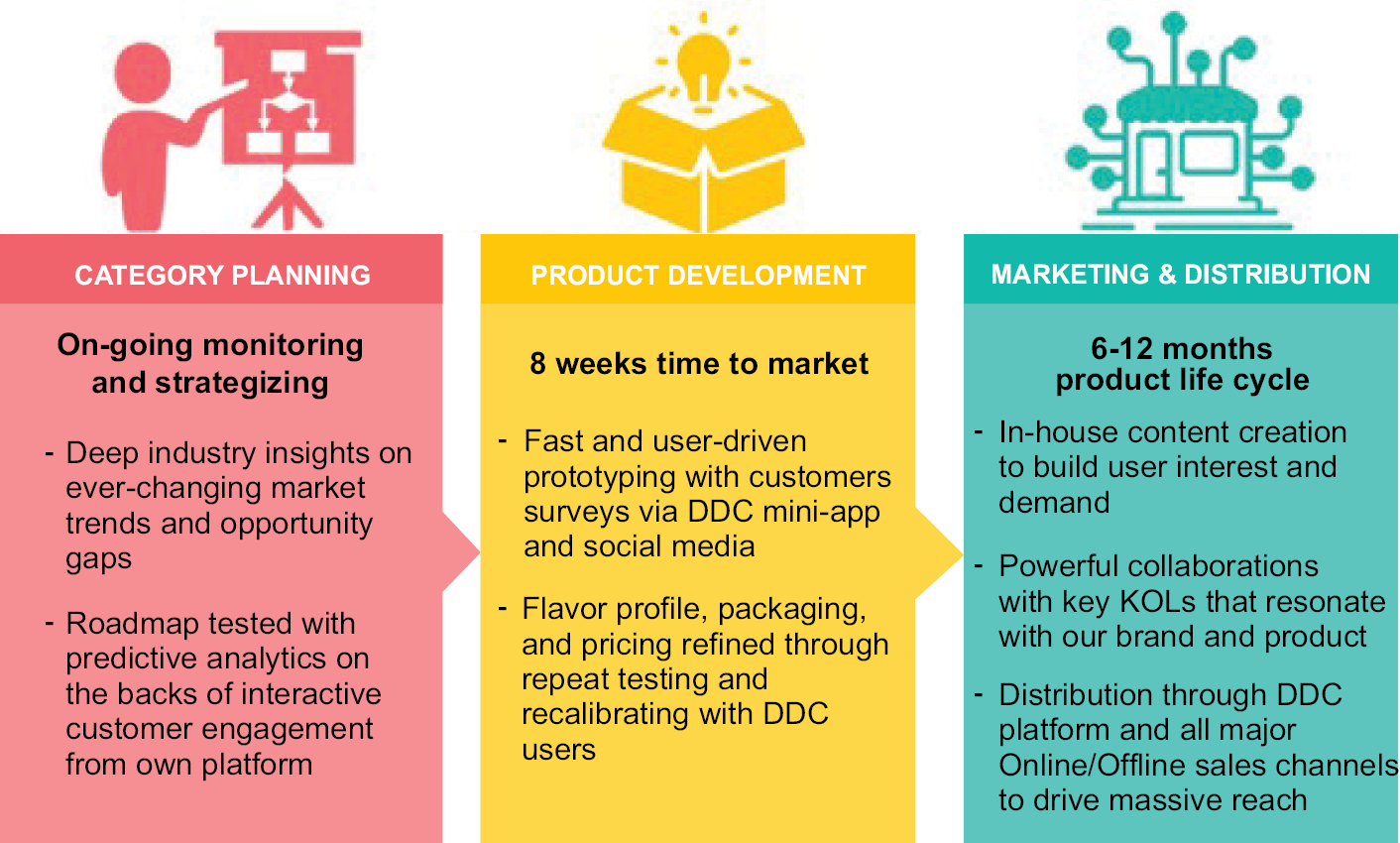

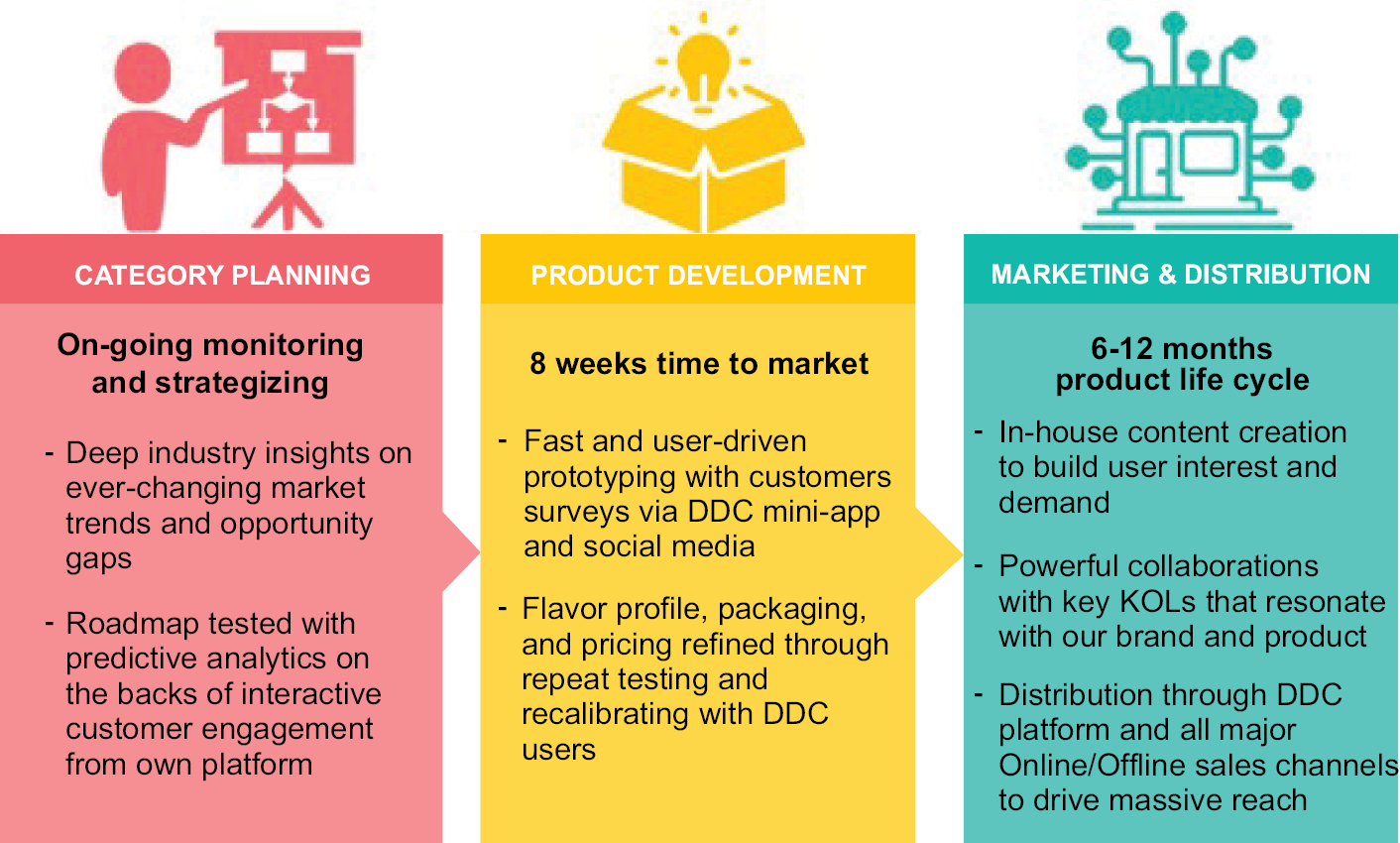

E2E Supply Chain Visibility, Agile Product Development and Go-to-Market (“GTM”) Capabilities

On average, we can deliver a new product to-market within 8 weeks. Our E2E supply chain visibility and strong product execution i.e., product concept, prototyping, product validation and recalibration, commercial manufacturing, product marketing and placement capabilities mean we can react in almost real-time to changes in customer needs and preferences. As part of our more proactive new product development strategy, we leverage our deep industry and cross-disciplinary expertise to uncover potential market and product opportunities. We have an in-house content development team which focuses on building interest and demand pre product launch. They will keep abreast of the latest market developments and identify potential trends and consumers interests. To promote our new products, we also collaborate with key opinion leaders (“KOLs” or “KOL”). We are well placed to continue to grow our market share and become the dominant player in the RTH, RTC, RTE, and plant-based meal products industry in mainland China.

5

Experienced Management Team, Board of Directors, and Advisory Network

We have an experienced management team. Members of our management team have significant experience across the FMCG, e-commerce, and IT services/technology, media, and telecommunications industries/sectors. More importantly, our management team comprises of a few selected individuals that offer strong understanding of the Chinese market as well as have extensive experiences in operating and expanding FMCG businesses in international markets.

In particular, our founder, Ms. Norma Ka Yin Chu, is a highly regarded entrepreneur and a true cooking enthusiast who has won numerous awards as a visionary entrepreneur in the cooking and lifestyle community. She was named as China New Media Top 100 people in 2016, and one of CY Zone’s Most Notable Female Entrepreneurs for three consecutive years from 2017 to 2019. In 2020, she was awarded the Outstanding ICT Women Awards 2020: Women Entrepreneur Category, Harper’s Bazaar The Visionary Woman 2020 and JESSICA Most Successful Women Award 2020 — Digital Women. Prior to founding our group, Norma was the Head of Research of HSBC Private Bank in Hong Kong. Therefore, not only does Ms. Chu have rich experience in the cooking and food products industry, she also has extensive experience in private equity, which together enable her to lead our group’s drive to become a leader in the market.

We further augmented the management team with a Board of Directors and an advisory network with significant operator expertise and experience spanning PepsiCo, General Mills, Danone and Meitu.

|

Name |

Previous Roles |

Description |

||

|

Chia Hung Yang |

Tuniu Corp., AirMedia, Dangdang Inc., and Goldman Sachs Group, Inc. |

• Mr. Yang has over 30 years of experience in capital market across the US & China, held C-level positions at several US-listed Chinese TMT companies • Former CFO of Tuniu, 51Talk, DangDang and AirMedia. Previously, Mr. Yang was a banker at Goldman Sachs, Morgan Stanley & Lehman Brothers • Mr. Yang currently serves as an independent director of I-Mab (Nasdaq: IMAB), Ehang (Nasdaq:EH), iQIYI (Nasdaq: IQ) and Up Fintech Holding (Tiger Securities) (Nasdaq: TIGR) |

6

|

Name |

Previous Roles |

Description |

||

|

Matthew Gene Mouw Independent Director |

Danone S.A., Barilla Group, MARS Inc |

• Mr. Mouw has over 30 years of extensive experience in the food industry, both convenience driven products such as confectionary, water & biscuits as well as planned purchase driven products such as juices, pasta and ready meals • Former Regional President Asia, Africa, and Australia for Barilla SpA. and General Manager for Danone S.A., in China • Mr. Mouw has experience with both emerging markets ranging from China to Turkey to Russia as well as developed markets ranging from Australia to Japan and Korea |

||

|

Sam Shih |

PepsiCo, Inc., Red Bull GmbH, Accor S.A, and OYO Rooms |

• Mr. Shih has over 30 years of experience in food & hospitality industry in China. • Mr. Shih is currently a Partner and Chief Operating Officer of OYO Hotel Company, a unicorn start-up backed by Softbank in China. • Previously Mr. Shih has served as CEO of PepsiCo Investment (China) Ltd., Asia Pacific Managing Director for Red Bull Gmbh as well as Chairman and CEO of Accor Great China |

||

|

Malik Sadiq, PhD Advisory Board Member |

The LIVEKINDLY Company, Inc., Tyson Foods, Inc., Arthur Andersen LLP, and Hitachi Vantara |

• Mr. Sadiq has more than 25 years of experience in the food and strategy consulting industry in China, India, and the US • Mr. Sadiq is currently the consulting business owner of Great Doorway Consulting • Previous roles include several senior management positions at Tyson Foods, most notably, CEO India, COO China, and Head of Global Sourcing and Business Optimization, COO of LIVEKINDLY Co, as well as the Vice President, Consumer Practice at Hitachi Consulting |

||

|

Chenling Zhang |

Primavera Capital Acquisition Corp, VCleanse |

• Being an investor, entrepreneur and influencer, Ms. Zhang started her career on Wall Street, raised NYSE- listed SPAC and founded her own company VCLEANSE as key suppliers of various popular brands • Ms. Zhang also works closely with a variety of global consumer brands, making contributions to their branding strategies and community building initiatives • Her roles include director of Primavera Capital Acquisition Corp and founder of VCLEANSE |

7

Our Strategies

International market expansion

Internationally, the development history of mature overseas RTC and RTE markets nurtures an extensive customer base of RTC and RTE products. The COVID-19 pandemic further stimulates such demands in overseas markets as it alters people’s lifestyle and increases health consciousness, especially in Southeast Asia,. Chinese companies in the RTC and RTE industry, attributable to their well-established value chains, are able to offer RTC and RTE products of competitive prices in markets like North America and Europe despite the additional logistic expenses. Thus, Chinese companies that are actively seeking international expansion opportunities are well positioned to further gain share in the global RTC and RTE market.

Moreover, around the globe, the public has been paying more attention to environmental and natural resources protection over the past decades. Compared to foreign brands, domestic Chinese brands pay more attention to the recipe R&D and introduce various plant-based meat food products into the market, covering from Western cuisine to Chinese cuisine, including but not limited to Panini, pizza, hamburgers, braised rice, pies, noodles, and other products to cater consumers. The processed volume of soybean protein and pea protein in China contributes nearly half of the global volume every year, which provides a significant advantage in raw materials for Chinese plant-based meat food products companies.

In view of the above and to the extent permitted due to our recurring losses from operations and an accumulated deficit, we are raising funds from investors for the purpose of expanding our business in the U.S. and Southeast Asia in hope of widening our customer base.

For the U.S., we have devised a three-fold strategy: (1) to launch our products through major Asian-focused online and offline sales channels, (2) to launch our direct-to-consumer stores on Amazon and our U.S. website, and (3) to grow through acquisitions. Since July 2022, we have successfully gained access to the U.S. market through sales on Yamibuy.com, one of the largest Asia food e-commerce platforms headquartered in the U.S.. In May 2023, we entered into a purchase agreement to acquire “Nona Lim”, an Asian food brand based in San Francisco, USA. The brand sells Ready-To-Cook Asian noodle meal kits and a variety of soup bases to its customers through an established distribution network in the United States, including major retailers such as Whole Foods Market, Target, and Kroger. The acquisition of Nona Lim was completed in July 2023. This acquisition enables us to expand our customer base into the US market. As for the Southeast Asian market, we are currently negotiating with local companies that would give us instant access to a growing customer base in the RTC and RTE meal markets.

Enhance our sales and marketing capabilities, as well as our sphere of influence

We will continue to monitor the performance of our e-commerce partners and platforms, adapt our product pricing strategy and offerings, and expand our fulfilment capabilities to support our revenue targets. We are raising funds from investors to deepen and broaden our existing partnerships and continue to expand cooperation with a wider network of influencers and KOLs to build our brand awareness. Also, we plan to engage more up-and-coming social e-commerce platforms to (i) drive higher traffic to our stores through more and closer collaborations; (ii) improve our ability to aggressively penetrate non-tier 1 cities and (iii) accelerate the growth of our paid customer base. In addition, we will continue to improve our sales and marketing capabilities and leverage the internet and various social media platforms to build brand awareness in non-Tier 1 cities in China. We will also engage content and social media marketing providers and platforms to drive an increase in average order value (“AOV”), repeat purchases, and to attract net-new users to our platform.

As of June 30, 2023, we had 24.5 million paid customers.

Continue to innovate and expand product offerings

We expect consumer demand for RTH, RTC, RTE and plant-based meal products to not only persist, but to grow at an accelerated rate. We plan to leverage our deep industry expertise, data-informed consumer insights, and predictive analytics to identify meaningful consumer trends and then partner with and solicit product feedback from our customers to optimize and expand on our existing product portfolio. We are committed to strengthening our R&D and product development capabilities to improve our ability to innovate more effectively within our core product categories.

8

Mergers and Acquisitions (“M&A”) Rollup

M&A is a key growth strategy going forward for the company in order for us to execute on the multi-brand strategy and also further diversify away from brand concentration risks and into markets outside of China. Historically, virtually all of our sales have been in China. For example, our international (meaning outside of China) sales were zero in 2022 and accounted for 0.17% of our total revenue for the six months ended June 30, 2023. M&A is an important part of our strategy to establish our footprint and sales channel internationally. We are actively looking at potential targets with revenues in the US, Europe, Australia, SE Asia, and Middle East. As a group, we are targeting to have international sales to account for 20 – 30% of total revenue in 2024 and around 50% in 2025. We have already identified several targets but to the extent permitted due to our recurring losses from operations and an accumulated deficit, we will evaluate and opportunistically execute on strategic joint ventures (JV), potential investments and acquisition opportunities across the value-chain with a focus on supplementing and/or complementing our existing products, sales channels, customer-base and/or allow us to optimize our existing brand marketing and sales channel management capabilities. There can be no assurances that we will be successful in generating revenues internationally. For example, our M&A strategy may not identify M&A candidates and acquisitions that are completed may not be successfully integrated into our operations and may not produce significant international revenues. Apart from executing acquisitions with considerations paid through share exchanges, we are also raising funds from investors to have an option to acquire companies through a mixture of cash and shares.

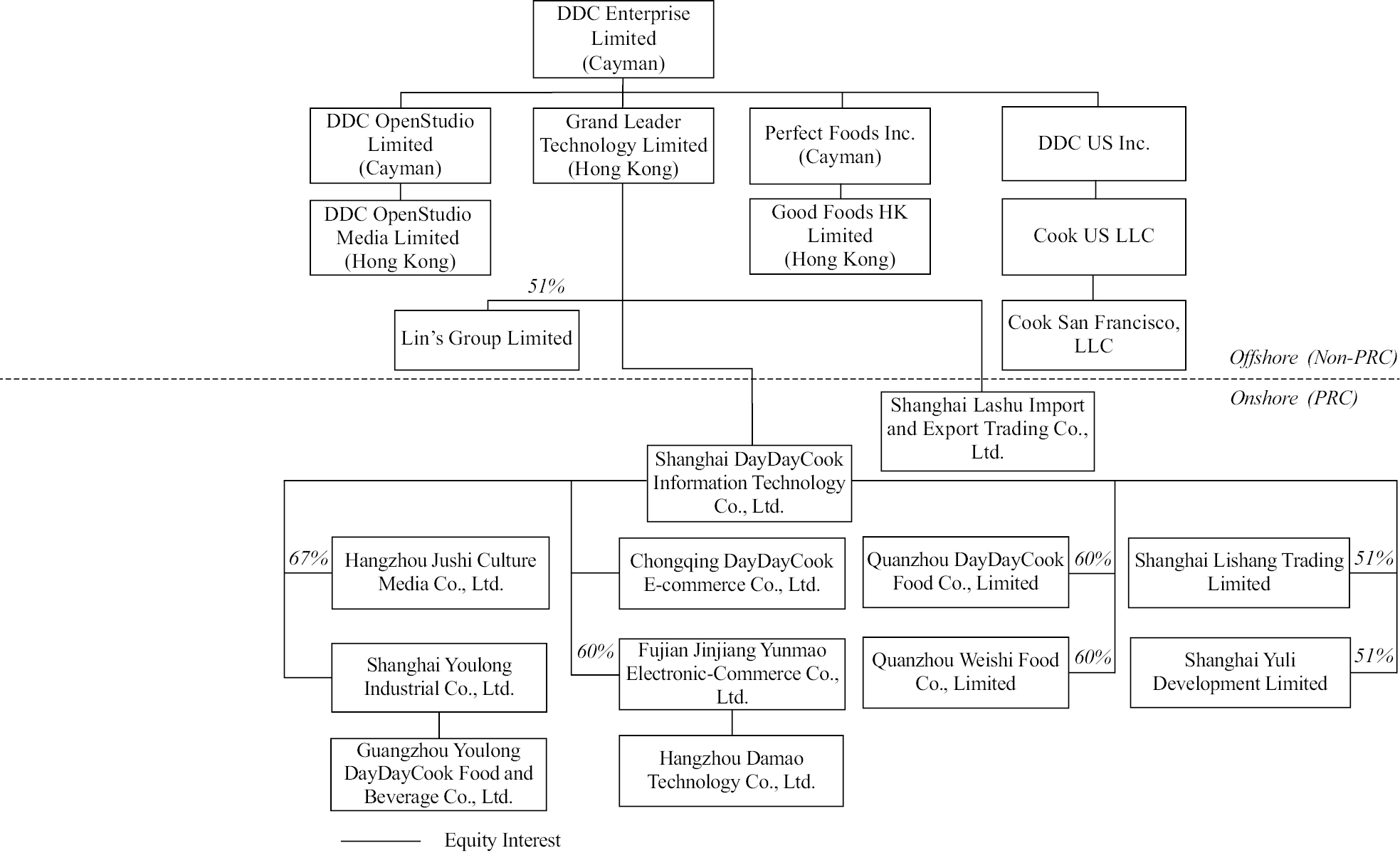

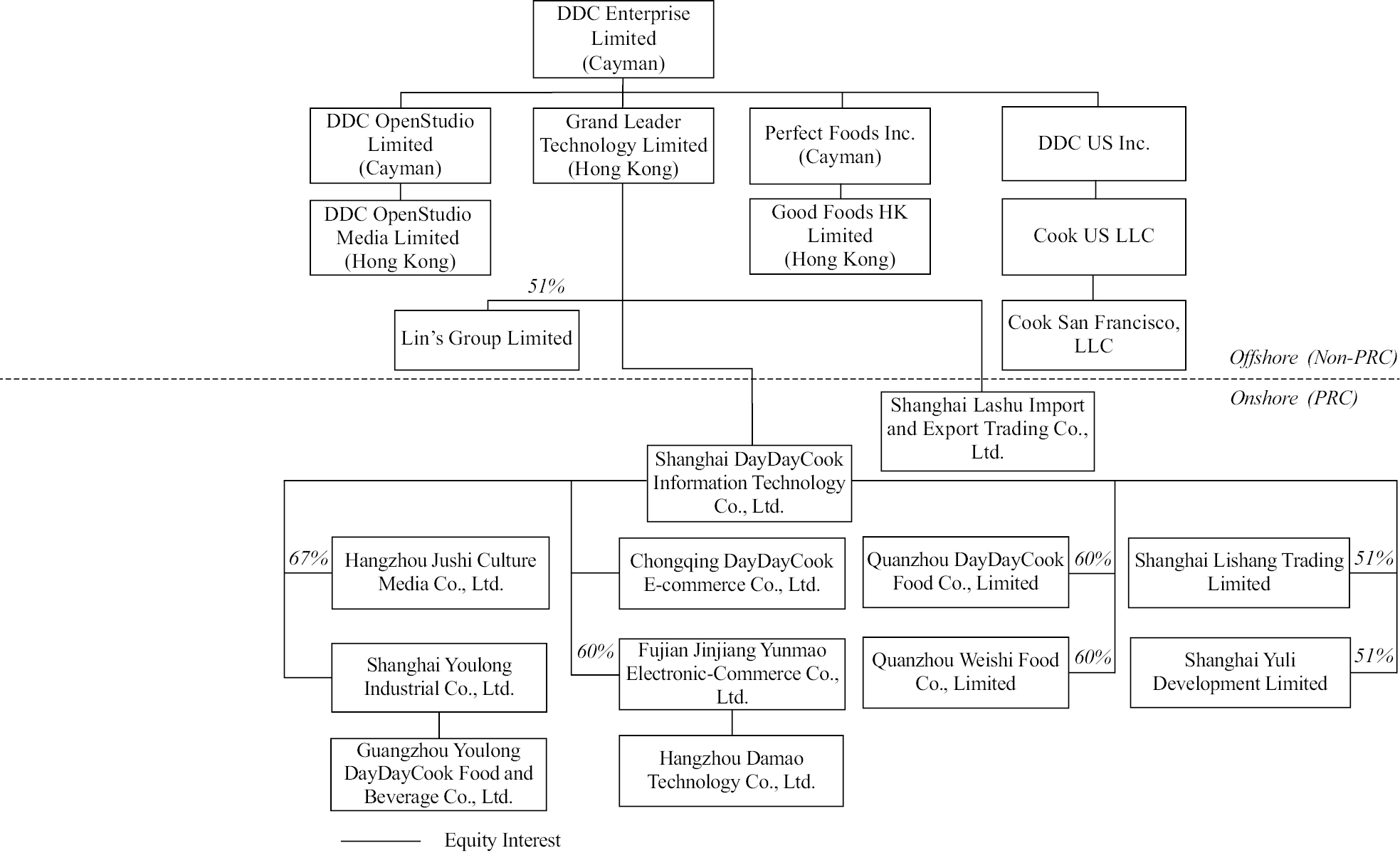

Corporate History and Structure

DDC Enterprise Limited (“DDC Cayman”) is a Cayman Islands holding company and conducts its operations primarily in China through its wholly-owned or controlled subsidiaries. We were founded in Hong Kong in 2012 by Ms. Norma Ka Yin Chu as an online platform which distributed food recipes and culinary content. Subsequently, we further expanded its business to provide advertising services to brands that wish to place advertisements on our platform or video content. In 2015, we entered the Mainland China market through the establishment of Shanghai DayDayCook Information Technology Co., Ltd. (“SH DDC”) and Shanghai Weishi Information Technology Co., Ltd. (“Weishi”). In 2017, we expanded our business from content creation to content commerce. Later in 2019, we extended our business to include the production and sale of, among others, own-branded RTH, RTC convenient meal solution products.

During the periods covered by the financial statements included elsewhere in this prospectus, SH DDC had entered into a series of contractual arrangement with Weishi and Shanghai City Modern Agriculture Development Co., Ltd. (“City Modern”), in 2016 and 2019 respectively, which allows SH DDC to exercise effective control over Weishi and City Modern and receive substantially all the economic benefits of Weishi, City Modern and their

9

consolidated entities (collectively, the “Weishi and City Modern VIEs”) via variable interest entity structures. As of the date of this prospectus, such contractual arrangements with the Weishi and City Modern VIEs have been terminated. After the termination of the contractual arrangements with Weishi, we will continue cooperation with it in certain online service areas. For instance, Weishi will develop and maintain the WeChat mini-program related to our business, ensure the ordinary operation of our official websites, make sure the cyber security of the systems and maintain our IT systems and servers. As advised by the PRC legal adviser, our continue cooperation with Weishi does not constitute a VIE because that, since the termination of the contractual arrangements with Weishi, (i) we have no longer enjoyed any controlling rights or decision-making power over the operation of Weishi; (ii) Weishi has independently operated its assets and properties and conducted its businesses, and its shareholder, instead of us, has enjoyed its residual interests and born the loss (if any); (iii) we and Weishi have no contractual relations other than the service contract to be signed between SH DDC and Weishi; and (iv) we have not enjoyed any interests or benefits, or any other transfers, contributed by Weishi, or offered any financial assistance for Weishi.

DDC Cayman directly and wholly owns (a) DDC OpenStudio Limited (“DDC OpenStudio”), a Cayman Islands company incorporated in May 2017, (b) Perfect Foods Inc. (“Perfect Foods Inc.”), a Cayman Islands company incorporated in September 2019 and (c) Grand Leader Technology Limited (“Grand Leader”), a Hong Kong company incorporated in January 2011. DDC OpenStudio in turn holds all the share capital of DDC OpenStudio Media Limited (“DDC OpenStudio Media”), which was incorporated in July 2018 in Hong Kong. Perfect Foods Inc. in turns holds all the share capital of Good Foods HK Limited (“Good Foods HK”), which was incorporated in September 2019 in Hong Kong.

Through its wholly-owned subsidiary Grand Leader, which was incorporated for the purpose of handling advertising, business-to-consumer e-commerce and cooking classes in Hong Kong, DDC Cayman owns a direct equity interest in SH DDC and Shanghai Lashu Import and Export Trading Co., Ltd. (“SH Lashu”). SH DDC was established in January 2015 in China for the purpose of engaging in technology development of computer hardware and software, food circulation and advertising production in China, whilst SH Lashu was established in August 2017 in China as an import and export vehicle in China.

As of December, 2017, Shanghai Youlong Industrial Co., Ltd. (“SH Youlong”), a wholly owned subsidiary of SH DDC, was established for the purpose of engaging in cooking class services, food and beverage and retail business in China. SH Youlong owns a direct equity interest in Guangzhou Youlong DayDayCook Food and Beverage Co., Ltd., which was established in March 2018 with its main business of engaging in cooking class services, food and beverage and retail business in China.

As of June 2019, Shanghai Juxiang Culture Media Co., Ltd. (“SH Juxiang”), a wholly owned subsidiary of SH DDC, was established for the purpose of engaging in e-commerce business in China. In June 2023, we sold a 33% equity interest in SH Juxiang to Haosheng Fan, and after giving effect to such sale, we hold a 67% equity interest in SH Juxiang. SH Juxiang’s name was changed to Hangzhou Jushi Culture Media Co., Ltd. (“HZ Jushi”) in September 2023.

In January 2019, SH DDC acquired 60% equity interest in Fujian Jinjiang Yunmao Electronic Commerce Co., Ltd. (“Yunmao”), a limited liability company incorporated under the Laws of the PRC, for a combination of a share option consideration equivalent to a value of RMB10.2 million, and a cash consideration of RMB10.2 million, to engage in food and beverage retail and e-commerce. Yunmao owns a direct equity interest in Hangzhou Damao Technology Co., Ltd., which was established in June 2020 with a main business of e-commerce.

In January 2021, SH DDC acquired a number of online stores from Chongqing Mengwei Technology Co., Ltd. (“CQ MW”), Liao Xuefeng, Chongqing Changshou District Weibang Network Co., Ltd. (“Weibang”) and Chongqing Yizhichan Snack Food Electronic Commerce Service Department (“Yizhichan”) (the “Transferors”). In July 2021, SH DDC and Chongqing Mengwei Technology Co., Ltd. set up a joint venture named Chongqing DayDayCook E-commerce Co., Ltd. (“CQ DDC”), which is established for accepting the online stores acquired and operating newly set-up online stores, in which, SH DDC holds 51% equity interest. CQ DDC was established for the purpose of engaging in online food retail business in China. However, due to certain limitations from the policies of third-party online platforms, the titles of such online stores currently could not be transferred to CQ DDC and the operation of such online stores were delegated to the Transferors through relevant contractual arrangements to enable us to have the ability to control such online stores. In April 2023, CQ MW sold its 49% equity interest to SH DDC, upon which CQ DDC became SH DDC’s wholly owned subsidiary. Also in April 2023, SH DDC acquired more Pinduoduo online stores from CQ MW, Weibang, Yizhichan and Chongqing Ningqi E-commerce Co. Ltd. (“Ningqi”), and operated these online stores in the same way. Therefore, these online stores were considered VIEs and SH DDC was the primary beneficiary. We refer to these online stores the “Mengwei VIE” throughout this prospectus.

10

On July 1, 2021, the Company, through its wholly owned subsidiary, SH DDC, entered into a purchase agreement (“the SPA”) with Mr. Zheng Dongfang and Mr. Han Min (“collectively the YJW Seller”), the shareholders of Fujian Yujiaweng Food Co., Ltd. (“Yujiaweng”) to acquire 60% interests of Yujiaweng’s product sales business, primarily including distribution contracts, the sales and marketing team, procurement team and other supporting function personnel (“the YJW Target Assets”). Yujiaweng is principally engaged in manufacturing and the distribution of snack foods. SH DDC and Mr. Zheng Dongfang agreed to form an entity (“YJW Newco”) with the Company holding 60% equity interest and Mr. Zheng Dongfang holding 40% equity interests. According to the SPA, during the period from July 1, 2021 until the date when YJW Newco is formed (“the transition period”), the Company manages and operates the Target Assets and is entitled to 60% of the net profit arising from the operation of the Target Assets.

On July 1, 2021, the Company, through its wholly owned subsidiary, SH DDC, entered into a purchase agreement (“the SPA”) with Mr. Xu Fuyi, (“the KeKe Seller”), the shareholder of Fujian Keke Food Co., Ltd. (“KeKe”) and Mr. Zheng Dongfang, the president of KeKe, to acquire a 60% interest in KeKe’s product sales business, primarily including distribution contracts, the sales and marketing team, procurement team and other supporting function personnel (“the KeKe Target Assets”). KeKe is principally engaged in manufacturing and distribution of candy products. SH DDC and Mr. Zheng Dongfang agreed to form an entity (“KeKe Newco”) with the Company holding 60% equity interest and Mr. Zheng Dongfang holding 40% equity interests. According to the SPA, during the period from July 1, 2021 and the date when KeKe Newco is formed (“the transition period”), the Company manages and operates the Target Assets and is entitled to 60% of the net profit arising from the operation of the Target Assets.

On February 1, 2022, the Company, through its wholly owned subsidiary, entered into a purchase agreement with Mr. LIN Kai Hang, Mr. SIO Leng Kit and Mr. Tang Wai Cheung, to acquire 51% shares of Lin’s Group Limited (“Lin’s Group”). Lin’s Group have its own brand “Deliverz” and principally engaged in manufacturing and distribution of RTC products with its major online sales channel. This was an upstream integration where Lin’s Group is the major supplier of RTC meal kits for the company’s Hong Kong operations. This acquisition allows the company to optimize cost structure for the RTC meal kits in the Hong Kong market. It also enables the company to expand its product offerings with its own production facility.

As of April 1, 2022, all contractual arrangements with Weishi and City Modern, have been terminated. As a result of the termination of the contractual arrangements with the Weishi and City Modern VIEs, we expect to be able to focus our capital and efforts on selling our products through online e-commerce platforms and offline distributors and retailers. We intend for the termination and discontinuation of business streams to reduce the company’s overall net losses, and free up capital to be allocated into our other fast growing RTH, RTC, RTE and plant based product businesses.

On May 1, 2022, the Company, through its wholly owned subsidiary, entered into a purchase agreement with Mr. Gao Xiaomin, Mr. Zhang Yi and Ms Chen Di, to acquire 51% shares of Shanghai Lishang Trading Ltd, (“Lishang”). Lishang is principally engaged in distribution of private label products. This acquisition was completed during the nation-wide lock down when the company expedited its strategy to diversify revenue streams and improve overall margin structure. Lishang has strong sales channel access into the corporate gifting channel which carries higher margin compared to the company’s existing e-commerce and offline distribution channels. By acquiring Lishang, the Company now has healthier gross margins as well as access to sales and distribution partnerships with global FMCG brands such as Pepsi Co (Lays brand.) These partnerships in turn can help the company secure better traffic and overall sales conversion on social commerce platforms to drive higher sales for its own branded product business.

On June 17, 2022, the “YJW Newco”, Quanzhou DayDayCook Food Co., Limited (“Quanzhou DDC”) was formed. As part of the transaction dated July 1, 2021, the YJW Target Assets and Keke Target Assets from the acquisition were transferred into Quanzhou DDC. And on the same day, SH DDC has obtained control over the YJW Target Assets and Keke Target Assets, and the results were consolidated into the Group.

11

On June 17, 2022, the “KeKe Newco”, Quanzhou Weishi Food Co., Limited was formed. The company does not hold any assets or operations.

As of August 19, 2023, all contractual arrangements with regard to Mengwei VIE have been terminated. As a result of the termination of the contractual arrangements of the Mengwei VIE, we expect to be able to focus our capital and efforts on selling our products through online e-commerce platforms and offline distributors and retailers to overseas markets. We intend for the termination and discontinuation of business streams to reduce the company’s overall net losses, and free up capital to be allocated into our other fast growing RTC, RTE and plant based product businesses.

The following diagram illustrates our corporate structure as of the date of this prospectus. Unless otherwise indicated, equity interests depicted in this diagram are held 100%.

Immediately upon consummation of this offering, our ordinary shares will be classified into Class A Ordinary Shares and Class B Ordinary Shares. In respect of matters requiring shareholders’ vote, each Class A ordinary share is entitled to one vote, and each Class B ordinary share is entitled to ten votes.

Government Regulations and Approvals for this Offering

As our operations are currently conducted through our operating entities established in Hong Kong and mainland China, we are potentially subject to significant regulations by various agencies of the Chinese government. The Regulations on Mergers and Acquisitions of Domestic Companies by Foreign Investors, or the M&A Rules, adopted by six PRC regulatory agencies in 2006 and amended in 2009, require an overseas special purpose vehicle formed for listing purposes through acquisitions of PRC domestic companies and controlled by PRC companies or individuals to obtain the approval of the CSRC and Ministry of Commerce of the PRC (“MOFCOM”), prior to the listing and trading of such special purpose vehicle’s securities on an overseas stock exchange. Substantial uncertainty remains regarding the scope and applicability of the M&A Rules to offshore special purpose vehicles. As at the date of this prospectus, we have been advised by Grandall Law Firm (Shanghai) that CSRC’s approval under the M&A Rules is not required for the listing and trading of our Class A Ordinary Shares on the NYSE Group in the context of this offering given that (i) our PRC subsidiaries were not incorporated by merger or acquisition of equity interest or assets of a PRC domestic company owned by PRC companies or individuals as defined under the M&A Rules that are DDC Cayman’s

12

beneficial owners; (ii) we are a company incorporated under the laws of the Cayman Islands controlled by non-PRC citizens and we do not fit into the definition of “overseas special purpose vehicle” under the M&A Rules; and (iii) the CSRC currently has not issued any definitive rule or interpretation concerning whether offerings like ours under this prospectus are subject to the M&A Rules. As such, we have never conducted any mergers or acquisitions of any PRC domestic companies with a related party relationship as prescribed in the M&A Rules. MOFCOM’s approval under the M&A Rules is also not required as we have never conducted any mergers or acquisitions of any PRC domestic companies with a related party relationship. We cannot assure you that relevant PRC governmental agencies, including the CSRC, would reach the same conclusion as we do.